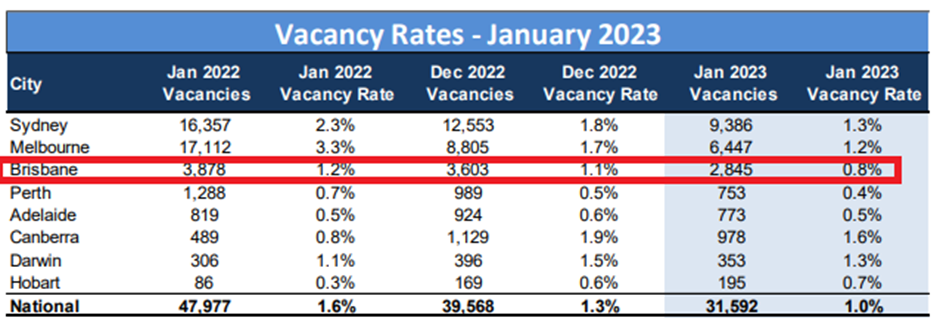

SQM Research has revealed national vacancy rates decreased in January back to 1.0% after the seasonal rise recorded over December 2022.

Rental Vacancy Rates

SQM Research has reported that vacancy rates in Brisbane have dropped back to their previous record low of 0.8%. Vacancy rates in Brisbane’s CBD have also dropped from 1.8% to 1.4%.

However, in bucking the trend, rental vacancy rates on Queensland’s Gold Coast continued to rise.

As previously noted, seasonal factors led to a brief rise in rental vacancies over December. However, the national rental market has returned quickly back to its extremely tight conditions and is likely to continue to record ongoing tight conditions, or worse over February and March. The surge in net overseas longer term and permanent arrivals relative to new residential property supply is ensuring extremely tight rental conditions will continue for the immediate future.

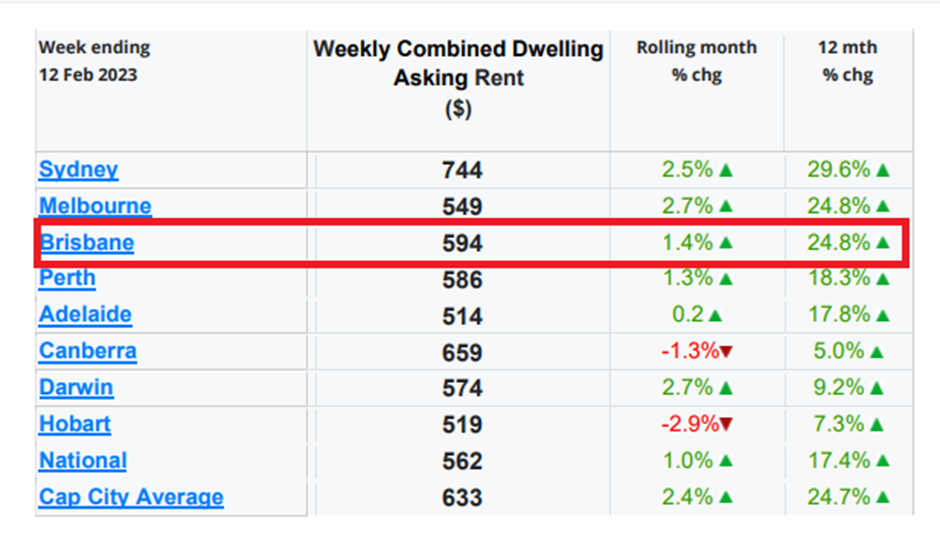

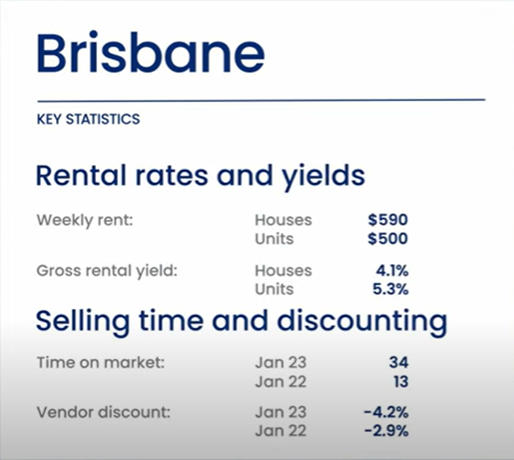

Rents

Over the past 30 days, Brisbane’s asking rents have recorded an increase of 1.4%.

Louis Christopher, Managing Director at SQM Research states: “We are expecting a further tightening in rental vacancy rates over the month of February based

on evidence that weekly listings have fallen again thus far in the current month. We have previously warned that the months of February and March will be the most difficult time for tenants in the national rental market in many years. Thereafter we are hoping for some relief given the expected increases in dwelling completions and an overall reduction in housing formation.

The ongoing surge in rents is pushing up rental yields, especially with falling prices. I believe ‘would-be’ investors will be attracted to higher rental yields in later 2023, provided the cash rate peaks at below 4%. However, if the cash rate rises above 4% it is likely home buyers including investors will largely stay away from the housing market for another year, and so investment dwelling approvals will remain in the doldrums, setting us up for another super tight rental market in later 2024 and 2025.”

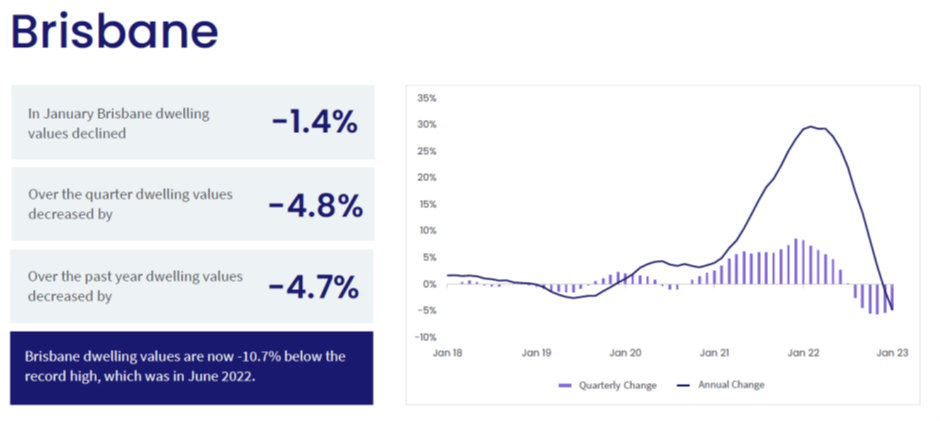

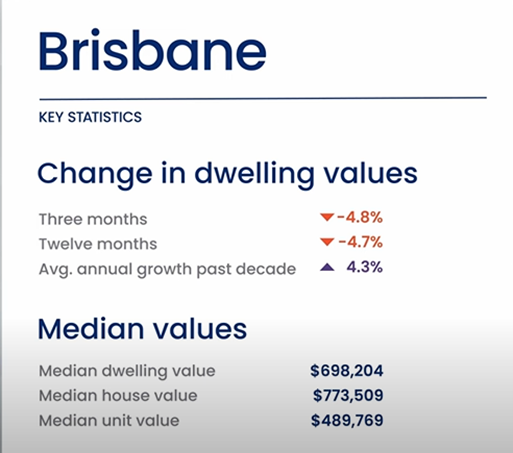

Property Value

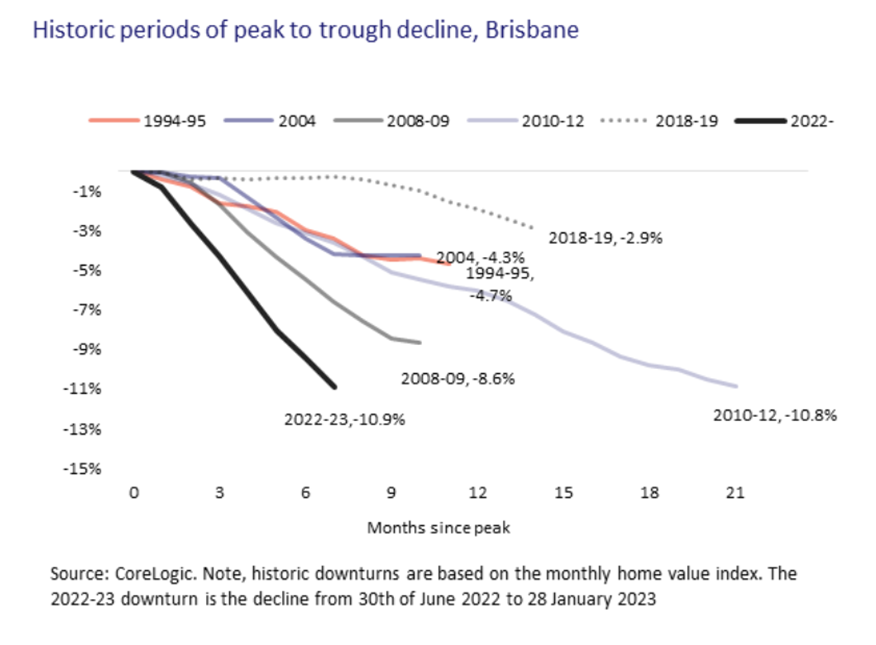

CoreLogic’s Daily Home Value Index (HVI) shows Brisbane’s home values declined 10.9% between the peak in June 2022 and 28 January, the largest percentage fall on record.

CoreLogic Head of Research Eliza Owen said: “The record fall in Brisbane home values has not made much of a dent in the gains made during the upswing. The fall in the Brisbane daily HVI follows an upswing of 43.5% between August 2020 and 19 June 2022, which was the fastest trajectory of rising values on record. This leaves home values across Brisbane 27.9% higher than at the previous trough in August 2020.”

Outlook for the Brisbane market

“While Brisbane property values are likely to fall further in 2023, it is possible the rate of decline will continue to slow over the coming months.”

CoreLogic reported that the pace of decline eased in January compared to November & December 2022.

Sources:

SQM Research. (2023). National Vacancy Rate January 2023. Accessed from: https://sqmresearch.com.au/12_1_2_National_Vacancy_Rate_December_2022_FINAL.pdf

CoreLogic. (2023). CoreLogic New and Research: Brisbane’s new record price fall barely dents pandemic gains. Accessed from: https://www.corelogic.com.au/news-research/news/2023/brisbanes-new-record-price-fall-barely-dents-pandemic-gains

CoreLogic Monthly Housing Chart Pack Feb 2023