CoreLogic’s Quarterly Rental Review for Q1 2023 reported: chronic supply shortage causes reacceleration of Australian rental market, with the national rental index rising 2.5%, up from 2.0% in the December quarter.

The RBA kept interest rates on hold in April for the first time in a year. Board members are concerned that current historically high levels of immigration may push up demand and inflation.

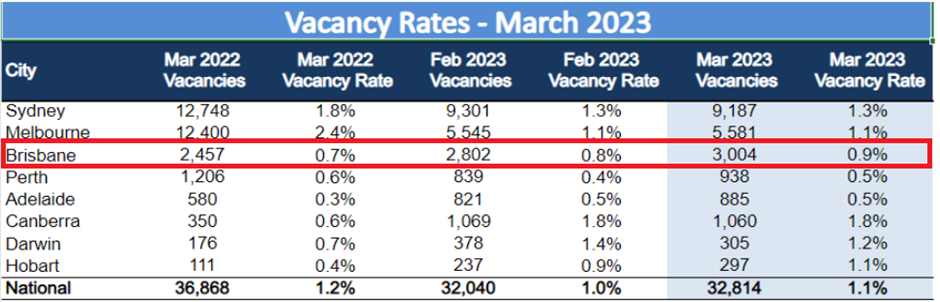

Rental Vacancy Rates

SQM Research reported on 12 Apr that national residential property rental vacancy rates rose slightly from 1.0% to 1.1% in the past 30 days. Vacancy rates in Brisbane and Brisbane’s CBD have both risen by 0.1% to 0.9% and 1.3% over March.

Rents

Over the past 30 days to 12 April 2023, the capital city asking rents rose by another 2.1% with the 12-month rise standing at 21.8%. Capital City house rents rose by 1.9% and are recording 12 month increases of 18.6%, while unit rents have risen by 2.3% for the past 30 days and are higher by 25.8% for the past 12 months.

The national median weekly asking rent for a dwelling is $568 a week. The capital city asking rent for a dwelling is $661 a week. The median rent for a capital city house is $758 a week while the rent for a capital city unit is $576 a week.

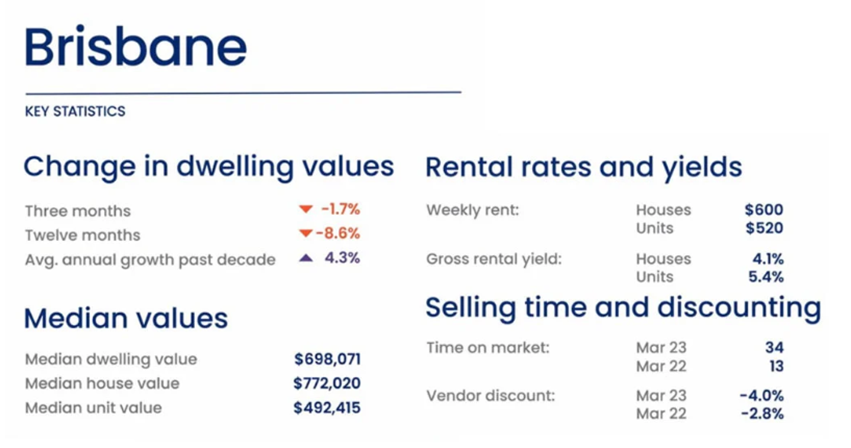

Brisbane’s rents have reflected this with a 1.1% increase for houses and units combined over March. This has led to 18.4% increase over the last 12 months for both houses and units combined.

Louis Christopher, Managing Director of SQM Research said: “The rental crisis in Australia’s regions has peaked with an easing in rental vacancy rates and rents across many smaller townships and coastal locations.

This peak also extends to some of our smaller capital cities such as Hobart, where rental vacancy rates rose back over 1% and rents are now down by 1.8% for the past 30 days. However, the same cannot be said for our two largest capital cities where the rental crisis rolls on, driven by rampant population growth, a slowdown in the respective construction pipeline and a return to the city office move from the regions.”

Property Value

Brisbane home values were virtually flat last month, but with a 0.1% change, this was the first monthly rise since June last year.

Both house and unit values recorded a modest lift over the month at 0.1% and 0.2%, but unit values have generally held much firmer than houses through the downcycle to date, down 2.1% since peaking compared with a 12.6% drop in house values.

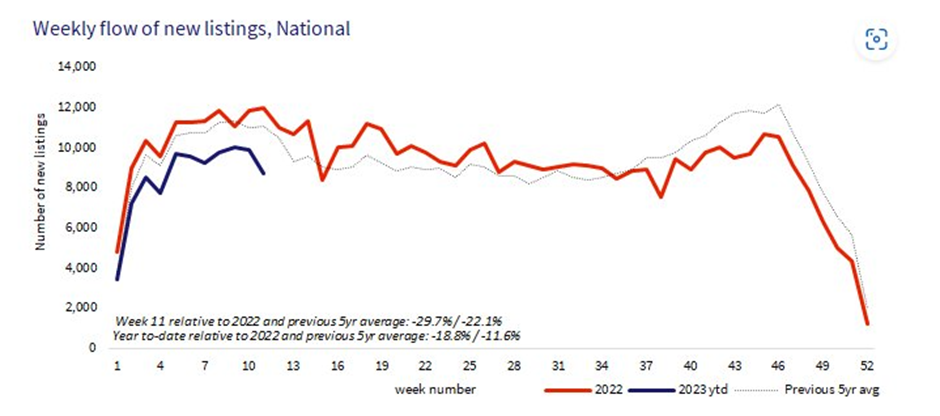

CoreLogic has recently reported that this year 8,721 new listings were added to the market in ‘week 11’ (March 11-19), down 27.3% compared to the same time last year, and 21.3% below the previous five-year average. So far in 2023 new listings nationally have been tracking 18.0% below 2022 levels.

The lower-than-average flow of fresh stock added to the market is likely to be a key factor supporting housing values. For the past month, CoreLogic’s Daily Home Value Index (HVI) has shown in some cities a lack of new stock has stemmed the decline in values.

Sources:

Ryan, P. (2023). The RBA’s interest rate pause was a close call that could change as early as next month. Accessed from: https://www.abc.net.au/news/2023-04-18/reserve-bank-minutes-interest-rate-pause-close-call/102235534

CoreLogic. (2023). Chronic supply shortage causes reacceleration of Australian rental market. Accessed from: https://www.corelogic.com.au/news-research/news/2023/chronic-supply-shortage-causes-reacceleration-of-australian-rental market

SQM Research. (2023). National Vacancy Rate March 2023. Accessed from: https://sqmresearch.com.au/uploads/12_04_23_National_Vacancy_Rate_March_2023_Final.pdf

CoreLogic. (2023). Seasonal New Listings Suffer As Sellers Hesitate. Accessed from: https://www.corelogic.com.au/news-research/news/2023/seasonal-new-listings-suffer-as-sellers-hesitate