We’re excited to bring you the latest updates on the property market.

Rental Vacancy Rates

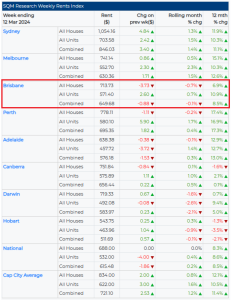

According to SQM Research, Vacancy Rates Remained Steady at 1.0%. Capital City asking rents rise at slower pace of 0.5%.

- Rental vacancy rate in Brisbane rose slightly from 0.9% to 1.0%.

- Vacancy rate in Brisbane CBD also increased from 2.1% to 2.3%

Asking Rents

Over the past 30 days to 15 April 2024, the capital city asking rents for all units continued its rising trend and rose by a further 1.3% with the 12-month rise standing at 9.2%.

- Median weekly asking rent for houses in Brisbane rose by 0.3%, with an annual increase of 6.6% and reached $716.67 per week.

- Unit rents rose by 1.4%, with a strong annual growth of 10.4%.

Overall, asking rents for combined dwellings increased by 8.1% over the past 12 months in Brisbane. The growth slows down than previous months.

Louis Christopher, Managing Director of SQM Research said:

“National rental vacancy rates for the month of March were actually up a little on the absolute numbers; but the overall vacancy rate just managed to stay steady. The immediate outlook is vacancy rates are set to rise somewhat into the cooler months. This is the normal seasonality we get at this time of year so one should be a little careful about reading into these rises. Nevertheless, it might provide some minor relief to tenants who still have excessive difficulties in finding longer term rental accommodation around the country.

The full year outlook remains the same in that we expect overall tight vacancy rates to be with us for 2024, driven by a fall in dwelling completions relative to growing demand.”

Property Values

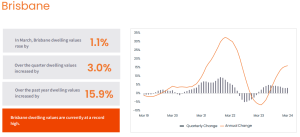

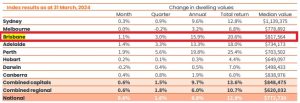

- Brisbane’s dwelling value rose by 1.1% in March

- Brisbane market has shown robust growth of 15.9% over the last 12 months.

- Brisbane median dwelling value surged to $817,564, with house values rose by 15.9% and unit values by 16.4% annually.

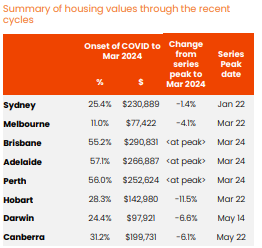

- Compared to the onset of COVID, housing values in Brisbane have risen significantly by 55.2%.

Experts advise that Brisbane continues to experience ongoing pressure for price growth.

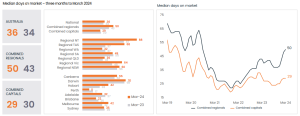

Median Days on Market

The time it takes to sell a home continued to trend higher in March. The median selling time for Brisbane remained at 22 days over the three months to March.

Cash rate

The RBA held the cash rate steady at 4.35 per cent for the third consecutive meeting in March.

Forecast

According to CoreLogic, housing markets are continuing to traverse the high interest rate and high cost of living environment better than most would have expected.

The outlook for housing values remains positive amid a growing expectation that interest rates will start to fall later this year, providing a boost to borrowing capacity and consumer sentiment.

The fundamentals of housing supply and demand remain out of balance in most regions, placing upwards pressure on the cost of housing.

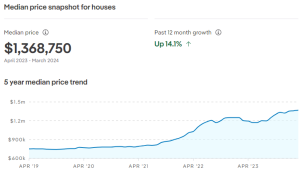

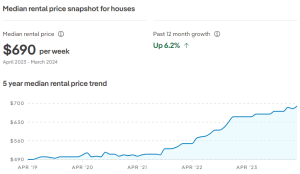

Suburb highlights – Eight Mile Plains

Eight Mile Plains had 53 properties available for rent and 55 properties for sale.

Median property prices over the last year range from $1,368,750 for houses to $592,500 for units.

Median price for houses-all Bedrooms:

Median rent for houses reached $690 PW with an annual rental yield of 3.2% and units rent for $590 PW with a rental yield of 5.0%.

Sources:

SQM Research. (2024). Vacancy Rates Remained Steady at 1.0% Available from:

https://sqmresearch.com.au/uploads/16_04_24_National_Vacancy_Rates_March_2024_Final.pdf

CoreLogic. (2024). Hedonic Home Value Index. Available from: Housing values record a subtle re-acceleration in February as sentiment improves (corelogic.com.au)

CoreLogic. (2024). Monthly Housing Chart Pack. Available from: content.corelogic.com.au/l/994732/2024-04-08/218yb1/994732/1712618034CnO47v5K/202404_monthly_chart_pack.pdf

realestate.com.au.(2024) Explore Suburb Profiles – Eight Mile Plains. Available from: https://www.realestate.com.au/qld/eight-mile-plains-4113/