Rental Vacancy Rates

SQM Research recorded the national residential property rental vacancy rates steady at 1.3% as at the month of July 2023. Vacancy rates for Brisbane remained unchanged at 1%.

Asking Rents

Over the past 30 days to 12 August 2023, the capital city asking rents rose by 1.2% with the 12 month rise standing at 18.5%.

Brisbane asking rents rose by 0.7% and are recording 12 month increases of 14.8% for houses and units combined. Asking rents for units rose by 0.6% over the past month while the annual increase of 20.4% is more significant than that of houses.

Louis Christopher, Managing Director of SQM Research said:

After the slight easing in vacancies over the first half 2023, this is somewhat of a disappointing result for tenants. Clearly, acute rental shortages remain with us. And besides more people grouping together to share the burden, there is no significant solution on the horizon. Where possible I would recommend tenants consider regional areas once again if their employment enables them to work off-site. I also encourage discussion about temporary migration caps, rather than rental caps, which will only make the rental crisis worse over the medium term. This problem has not been instigated by so called, greedy landlords. Rather, it has been driven by rampant population growth. Australia currently has, by far, the fastest growing population for any OECD country and clearly the rampant increases are currently breaching the country’s capacity to house all our people.”

Property Value

CoreLogic’s national Home Value Index (HVI) rose 0.7% in July marking a fifth consecutive month of housing value recovery. Since finding a floor in February, the national HVI is up 4.1%, following a 9.1% decline from record highs in April 2022.

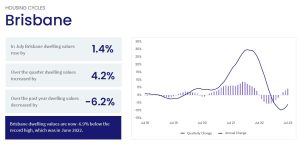

Brisbane and Adelaide saw the monthly pace of growth accelerate in July, leading the pace of gains across the capitals with housing values up 1.4% across both cities. Although the trend in new listings has risen in these cities, Mr Lawless said the number remains well below levels from a year ago and the previous five year average.

Very low levels of advertised supply have been vital in keeping a floor under housing prices and supporting a market recovery.

“With an increase in the flow of fresh listings coming to market, we could gradually see the supply side becoming more balanced if housing demand doesn’t pick up at the same pace,” Mr Lawless said. “To date, the rise in new listings has been absorbed, with total stock levels remaining well below average, but this will be a trend to watch.”

On the demand side, there is evidence that buyers have become more active despite the highest interest rates since 2012 and sentiment levels holding around GFC lows.

Housing finance data to May showed the number of home loan commitments was the highest since August last year and the value of lending has been trending upwards since March, aligning with the rise in home values.

The lift in demand is also supported by higher sales activity, with CoreLogic estimating that sales over the past three months were slightly above the previous five-year average.

With inflation coming in lower than expected for the June quarter, it’s looking increasingly likely the interest rate cycle is at or near a peak. The June quarter inflation reading was the lowest since September 2021, which should help to lift consumer spirts. With sentiment and housing activity showing a close relationship, a rise in consumer sentiment should help to support a further lift in housing activity. However, we don’t expect to see a material lift in purchasing activity until interest rates start to reduce, which isn’t likely until 2024.

Housing demand from strong population growth is set to remain a feature over the coming years. Net overseas migration is expected to hold at above average levels over the coming years, underpinning housing demand against a backdrop of persistently low dwelling approvals.

Suburb highlights – Eight Mile Plains July 2023

Last month Eight Mile Plains had 58 properties available for rent and 63 properties for sale. Median property prices over the last year range from $1,168,000 for houses to $527,000 for units. If you are looking for an investment property, consider houses in Eight Mile Plains rent out for $650 PW with an annual rental yield of 3.3% and units rent for $525 PW with a rental yield of 5.0%. Based on five years of sales, Eight Mile Plains has seen a compound growth rate of -1.4% for houses and 7.8% for units.

Sources:

SQM Research. (2023). July Sees Steady Vacancy Rate at 1.3%. Available from: https://sqmresearch.com.au/uploads/15_08_23_National_Vacancy_Rate_July_2023_Final.pdf

CoreLogic. (2023). Hedonic Home Value Index. Available from: https://www.corelogic.com.au/__data/assets/pdf_file/0021/16572/CoreLogic-HVI-Aug-2023_FINAL.pdf