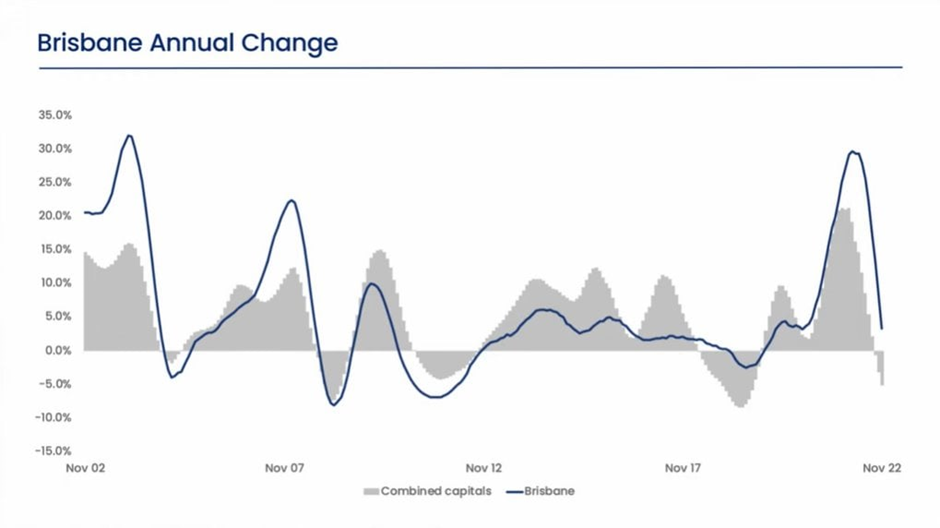

One of the distinctive features of capital growth in 2022 was a slowdown in the pace of decline toward the end of the year. National value falls eased to -1.0% in November, following the steep monthly falls of -1.6% in August.

Ms Owen, Head of Australian Research from CoreLogic said although declines have been slowing, suggesting we may have moved past the peak home value declines, further rate rises are anticipated in the early months of 2023, which could cause the rate of decline to pick up speed once more.

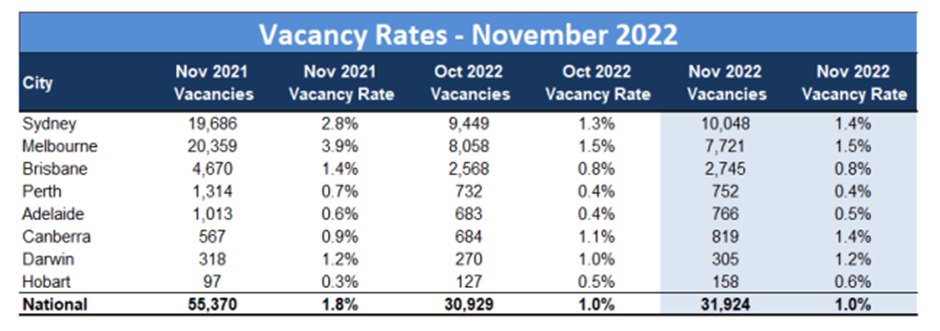

Rental Vacancy Rates

SQM Research reported: Brisbane vacancy rates remained steady at 0.8% similar to the previous month. Vacancy rates in Brisbane’s CBD rose to 1.4% from 1.2%. Rental conditions in areas outside of Brisbane, such as the Gold Coast and Ipswich, remain extremely tight with vacancy rates at record lows of 0.6% but slowly climbing.

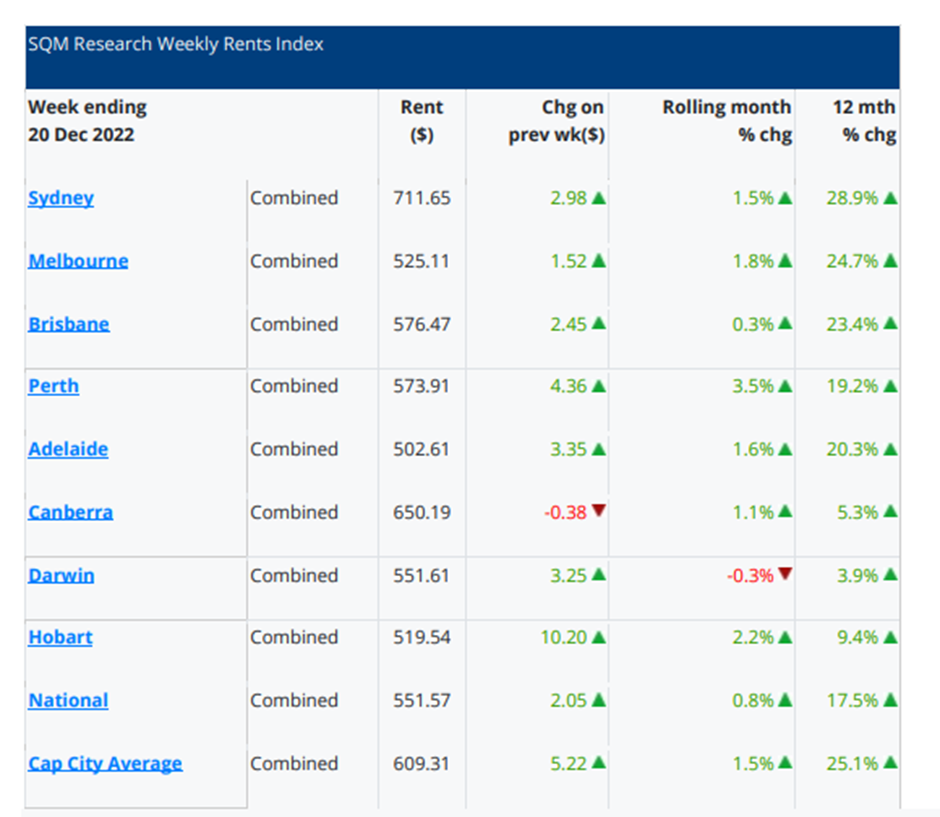

Over the past 30 days to 20 December 2022, Brisbane asking rents increased by a further 1.5% with the 12-month rise now standing at 25.1%.

The immediate outlook is ongoing extreme tightness in the rental market. February/March tends to be a very seasonally difficult time for tenants looking for rental properties and given the already low rental stock on the market, early 2023 could be a nightmare for would be tenants.

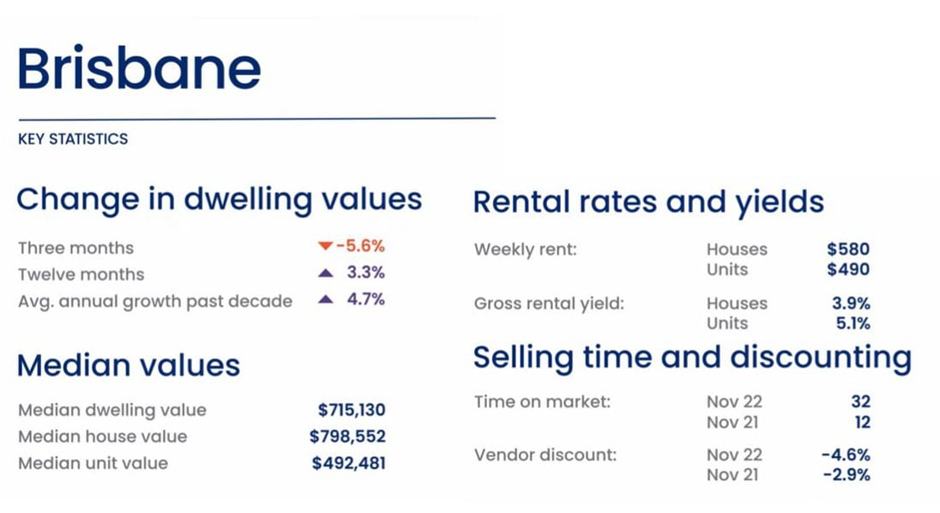

Property Value

The CoreLogic Research team released the latest data: Brisbane housing values were down a further -2% in November, on par with Hobart as the largest monthly decline and consistent with October.

Since peaking in June, Brisbane home values have dropped by -8.1%, the second largest fall from peak after Sydney where values are down -11.1% since peaking in January.

Reflecting the enormity of the recent upswing, Brisbane housing values remain 30.4% above pre-Covid levels.

Home sales have reduced by about -18% relative to last year but remained about 14% above the five-year average over the past three months.