Vacancy Rates

SQM Research has revealed national residential property rental vacancy rates continue to rise to now stand at 1.3% as at the month of June 2023. Rental vacancy rates were steady in Brisbane at 1.0%.

Louis Christopher, Managing Director of SQM Research said: “Following the SQM update today there is now more evidence that we are past the worst of our national rental crisis with an easing in vacancy rates recorded for our largest capital cities and a material slowdown on market rent increases. “Now, at 1.3%, the rental crisis is not yet over and given our ongoing strong population growth rates it is very unlikely we will get to an oversupply of rental properties anytime soon. However, just an easing in the crisis can at least translate to a steadying of market rents after what has been an extended period of very rapid market rent growth.”

Property Rents

Over the past 30 days to 12 June 2023, Brisbane asking rents rose by 1.2% with the 12- month rise standing at 14.3% (house and unit combined). House rents rose by 1.0% and are recording 12 month increases of 10%, while unit rents have risen by 1.6% for the past 30 days and are higher by 21.4% for the past 12 months.

Property Value

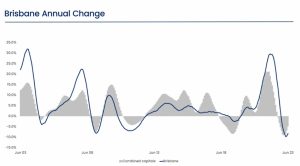

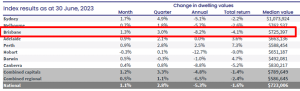

Australian housing values moved through a fourth month of recovery with CoreLogic’s national Home Value Index (HVI) rising 1.1% in June, decelerating slightly from the 1.2% gain recorded in May. Brisbane’s home values posted the second largest monthly rise of any capital city in June with a 1.3% lift. Dwelling values are up 3.1% since reaching a floor in February 2023 but the market still has further to go to recover the 11% drop recorded during the downturn. Nevertheless, most homeowners remain in a very strong equity position with Brisbane housing values still 30.1% higher than the onset of COVID in March 2020.

A lack of available supply continues to be the main factor keeping upwards pressure on housing values, Mr Lawless said. “Through June, the flow of new capital city listings was nearly -10% below the previous five-year average and total inventory levels are more than a quarter below average. Simultaneously, our June quarter estimate of capital city sales has increased to be 2.1% above the previous five-year average.”

Although housing values continue to record a broad-based upswing, the pace of growth across most capitals eased in June. Regional housing values have also trended higher, albeit at a slower pace relative to the capitals. The combined regionals index also recorded a fourth consecutive month of growth, taking housing values 1.2% higher than the recent low in February.

Although the recovery trend is becoming entrenched over the past four months, the outlook for housing values remains uncertain amidst an expectation of higher interest rates, weaker economic conditions and stretched household balance sheets. The trajectory of interest rates will be a critical factor in the housing markets performance, even after the RBA’s July decision to hold the cash rate at 4.1%.

SQM Research. (2023). National Vacancy Rate June 2023. Accessed from: https://sqmresearch.com.au/uploads/11_07_23_National_Vacancy_Rate_June_2023_Final.pdf

CoreLogic. (2023). Brisbane Housing Market Update | July 2023 [Video]. YouTube. Accessed from: https://www.youtube.com/watch?v=ur8ZNj3DouA

CoreLogic. (2023). Hedonic Home Value Index 3 July 2023 [PowerPoint]. Accessed from: https://www.corelogic.com.au/__data/assets/pdf_file/0016/15910/CoreLogic-HVI-Jul-2023-FINAL.pdf