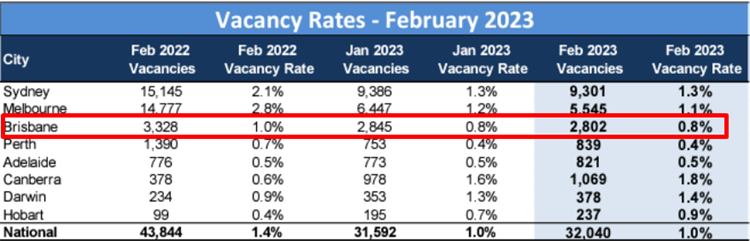

SQM Research today has revealed national residential rental vacancy rates remained steady over the month of February 2023 at 1.0%.

Rental Vacancy Rates

Vacancy rates in Brisbane have also remained steady at the previously recorded 0.8%. Meanwhile, in Brisbane’s CBD, vacancy rates have continued dropping from 1.4% to 1.2%, most likely reflecting the sudden surge in demand from international students.

SQM Research regards today’s rental figures as a surprise result and represents welcome relief to some tenants, though ongoing extreme tight rental conditions persist for most of the capital cities. The surge in net overseas longer term and permanent arrivals relative to new residential property supply is ensuring extremely tight rental conditions remain with our two largest capital cities.

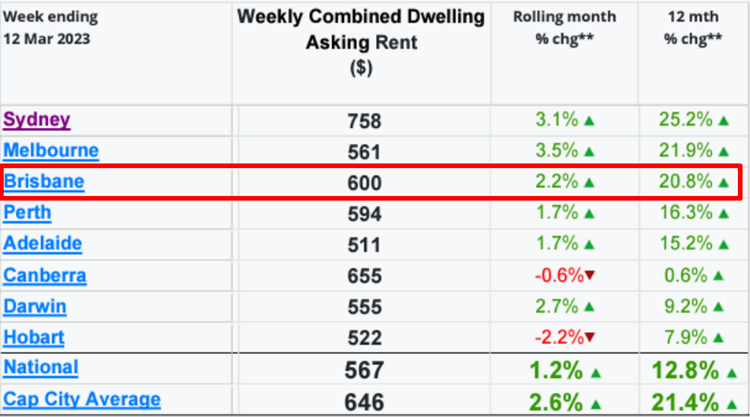

Rents

Over the past 28 days leading to March 12, Brisbane’s asking rents have recorded a further increase of 2.2% with the 12-month rise standing at 20.8%. While national rents across all regions rose by a slower 12.8% for the same 12-month period. The national rental increase may now be mimicking the trough and rise in rental vacancy rates recorded across the different regions.

Louis Christopher, Managing Director of SQM Research said: “I was expecting a decline in rental vacancy rates over February. However, the result came in steady and indeed we recorded sharp rises for some regions. Further, I think we now have hard evidence that the rental crisis is now easing in Canberra, Darwin and Hobart. It isn’t just February we have recorded rises in these cities; they are also up compared to this time in 2022.

Could we be seeing some light at the end of the tunnel for our national rental crisis? Perhaps for some cities and regions, yes. However, we still remain very concerned for the situation in Melbourne, Sydney and Brisbane where most international arrivals first land.”

Property Value

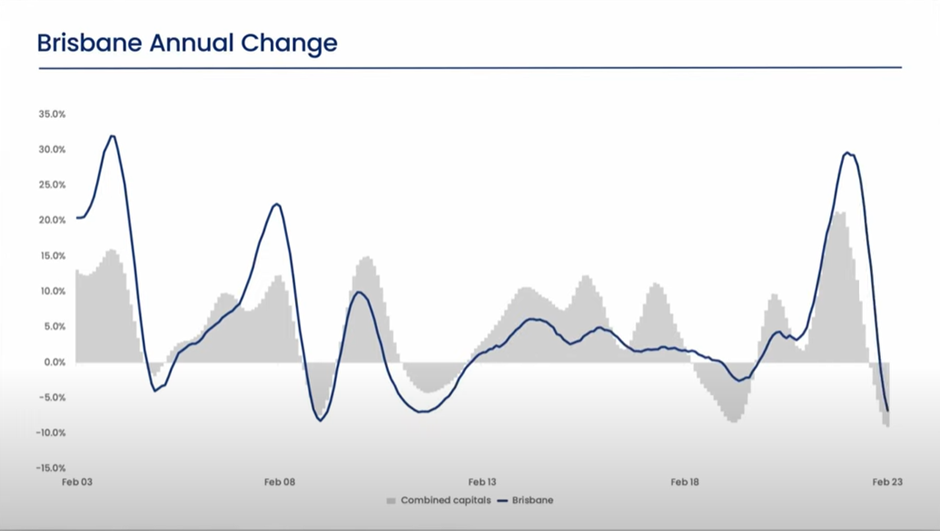

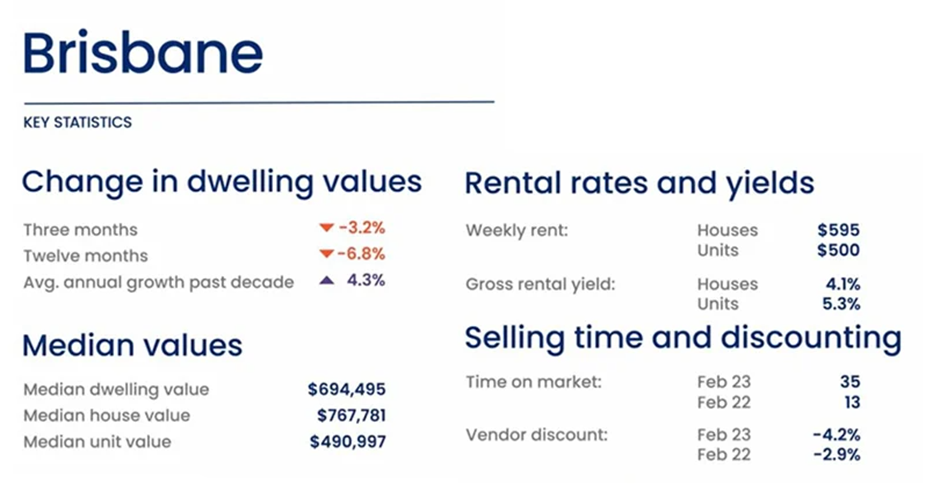

CoreLogic’s latest monthly data shows that the monthly pace of decline eased substantially in February.

Despite a large annual decline in home values, the monthly pace of decline slowed quickly over February to just -0.4% in Brisbane.

Since peaking in June last year, Brisbane’s home values declined by 11%, which is the largest decline on record. Brisbane’s home values are still 26% above their pre-COVID levels.

A 12.7% drop in house values has been the main driver of Brisbane’s downturn, while unit values have held remarkedly firm, falling by only 2.3% since peaking in July last year.

CoreLogic Research Director, Tim Lawless, said the stabilisation in housing values over the month coincides with consistently low advertised supply levels and a rise in auction clearance rates.

Sources:

SQM Research. (2023). National Vacancy Rate. Accessed: https://sqmresearch.com.au/14_3_2_National_Vacancy_Rate_February_2023_FINAL.pdf

CoreLogic. (2023). Monthly Housing Chart Pack. Accessed: https://www.corelogic.com.au/news-research/news/2023/monthly-housing-chart-pack-march-2023

CoreLogic. (2023). Home Value Index: Value declines flatten as low advertised stock levels keep a floor under prices. Accessed: https://www.corelogic.com.au/news-research/news/2023/corelogic-home-value-index-declines-flatten-as-low-advertised-stock-levels-keep-a-floor-under-prices?utm_medium=email&utm_source=newsletter&utm_campaign=au-res-hvi-2023-mar