Rental Vacancy Rates

SQM Research recorded that the residential property market tightened again, with the national vacancy rate dropped to 1.0% in October.

Most of capital cities recorded a decrease in vacancies, with Brisbane experiencing a decrease from 1% to 0.9% in vacancy rate.

Asking Rents

Over the 30 days as of 12 November, 2023, asking rents in the capital cities rose by 0.7%, contributing to a significant increase of 15.5% rise over the past year.

Asking rents for houses in Brisbane increased by 1.9%, resulting in 10.4% increase over 12-month period. Meanwhile, unit rents recorded no change during this period. Asking rents for combined dwellings rose by 12.2% over the past 12 months, indicating a slowdown in the growth pace.

Louis Christopher, Managing Director of SQM Research said:

“After a minor reprieve earlier this year, we are back to the record low in rental vacancies of 1.0%. Vacancies have been tightening again across the nation. They are tightening in our regions as well as our cities.

In such an environment, the prospect of an easing in rents over the next six months is very unlikely to occur. And most likely, market rental increases will continue to rise between 10 to 15%. Such rises will continue to work against the RBA’s objective of bringing back inflation to 2% to 3%.

Given 2024 is very likely to see a fall in dwelling completion to about 153,000 dwellings, the only real prospect of having some relief in the rental market next year is a cap on migration rates. I have no doubt the runaway population growth Australia has had, since the start of 2022 is directly contributing to our rental crisis and towards other price rises in the greater economy.”

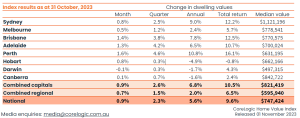

Property Value

Corelogic’s Hedonic Home Value Index indicates that Brisbane dwelling values reached a record high. It rose by 1.4% in October, trending only behind Perth which recorded 1.6% increase.

Brisbane housing values have increased by 10.2% over the first 10 months of this year, outperformed the other capital cities.

Low levels of supply have been a key factor supporting the recovery. Total advertised listings are 18.6% lower than last year. Additionally, Brisbane has been attracting record high interstate migration that created strong buyer demand.

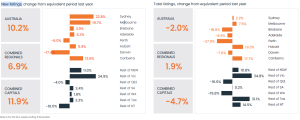

Listings

New listings increased significantly across most capital cities compared to the same period last year. However, total listings remain lower than the previous year in Brisbane (-18.6%), Adelaide, Perth, and Darwin.

Median days on market

The amount of time it takes to sell property increased slightly through the three months to October, with the median days on market nationally reaching 30 days.

Selling conditions are stronger, with the median selling time shortened to 26 days from 30 days in capital cities in the same period of 2022.

Cash rate

The RBA decided to increase the cash rate by 25 basis points in November to 4.35%. This is the 13th rate hikes since May 2022.

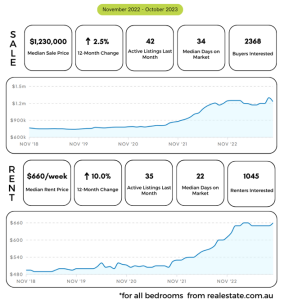

Suburb highlights – Eight Mile Plains

- 63 properties available for rent

- 75 properties for sale

- Median price for units $553,500

- Median rental price for houses $660 per week with an annual rental yield of 3.4%

- Units rent for $555 PW with a rental yield of 5.1%

Sources:

SQM Research. (2023). Rental Market SqueezeOctober Vacancy Rates Back to 1.0%. Available from: https://sqmresearch.com.au/uploads/14_11_23_National_Vacancy_Rate_October_2023__Final..pdf

CoreLogic. (2023). Hedonic Home Value Index. Available from: https://www.corelogic.com.au/__data/assets/pdf_file/0018/19161/CoreLogic-HVI-Nov2023-FINAL.pdf

CoreLogic. (2023). Monthly Housing Chart Pack. Available from: https://www.corelogic.com.au/news-research/news/2023/monthly-housing-chart-pack-november-2023

realestate.com.au.(2023) Explore Suburb Profiles – Eight Mile Plains. Available from: https://www.realestate.com.au/qld/eight-mile-plains-4113/