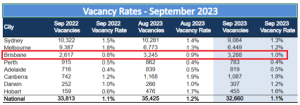

Rental Vacancy Rates

SQM Research recorded that the national residential property rental vacancy rate has continued to fall, reaching 1.1% in September. This reflects the severity of the rental crisis in Australia.

Contrary to most capital cities, Brisbane recorded a slight increase from 0.9% to 1%, while the Brisbane CBD fell to 1.7% in the rental vacancy rate in September.

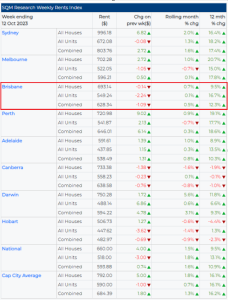

Asking Rents

In the 30 days leading up to October 12, 2023, asking rents in capital cities increased by 1.3%, contributing to a notable 16.2% rise over the past year. The increase was higher than last month’s growth.

Brisbane house rents increased by 0.7% with a 12-month increase of 9.5%. Unit rents have continued to increase by 0.1% with an annual increase of 16.7%, with growth slowing compared to the previous month.

Louis Christopher, Managing Director of SQM Research stated:

The national rental market continues to tighten and going forward, based on falls in rental listings for October to date, we could see a record low in rental vacancy rates [currently standing at 1.0%] for this present month. Current net overseas arrivals suggests the population is expanding at an annual rate of some 650,000 people, which obviously is keeping pressure on the national rental market, especially given approximately 175,000 new dwellings have been completed over the past 12 months. What is also noteworthy in September was the return to very tight rental conditions for Australia’s regional townships. It would suggest the population overflow is making many look once more to areas outside the capital cities in order to find shelter. Going forward, the market may find some seasonal relief after October, however it is unlikely rental growth will pause.”

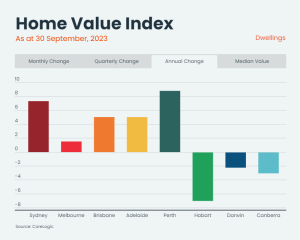

Property Value

CoreLogic’s national Home Value Index (HVI) recorded a 0.8% rise in September as the recovery trend moved through an eighth consecutive month of growth.

Brisbane’s home values rose by 1.3% in September. CoreLogic’s research director, Tim Lawless noted that Brisbane looks set to reach a new record high in October, with home values currently only 0.6% below their previous peak.

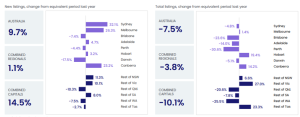

New listings are now trending higher than a year ago across five capital city markets. Total listings in Brisbane are 23.6% lower than the same period last year.

Median days on market

The amount of time it takes to sell property shortened in the three months to September in Brisbane, from 25 days during the previous reporting period to 22 days.

Cash rate

The RBA held the cash rate at 4.1% for the fourth consecutive month in September. The Board noted “some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon the data and the evolving assessment of risks.“

Suburb highlights – Eight Mile Plains

Eight Mile Plains had 56 properties available for rent and 64 properties for sale In September.

Median property prices over the last year range from $1,275,000 for houses to $540,000 for units.

Houses rent out for $650 PW with an annual rental yield of 3.4% and units rent for $550 PW with a rental yield of 5.1%.

Based on five years of sales, Eight Mile Plains has seen a compound growth rate of 9.0% for houses and 8.1% for units.

Sources:

SQM Research. (2023). September Vacancy Rates fall back to 1.1%. Available from:

https://sqmresearch.com.au/uploads/17_10_23_National_Vacancy_Rate_September_2023_Final.pdf

CoreLogic. (2023). Hedonic Home Value Index. Available from:

CoreLogic. (2023). Monthly Housing Chart Pack. Available from: content.corelogic.com.au/l/994732/2023-10-11/zjh29/994732/16969989679hhDUzmr/202310_Monthly_Chart_Pack.pdfHome Value Index