We’re excited to share some updates on Brisbane property market that may be of interest to you.

Rental Vacancy Rates

According to SQM Research, national vacancy rates continued to decrease and now states at 1.0% over February.

- Rental vacancy rate in Brisbane fell from 1.0% to 0.9%.

- Vacancy rate in Brisbane CBD also declined sharply from 2.5% to 2.1%.

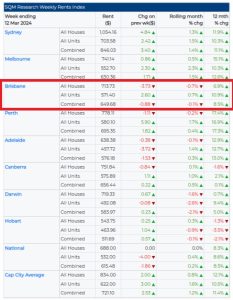

Asking Rents

Over the past 30 days to 12 March 2024, capital city asking rents rose by a further 1.2% with the 12-month rise standing at 11.4%.

Median weekly asking rent for houses in Brisbane decreased slightly by 0.7%, with an annual increase of 6.9% and reached $713.13 per week.

Unit rents experienced a slight rise of 0.7%, with a substantial annual growth of 10.9%. Overall, asking rents for combined dwellings increased by 8.5% over the past 12 months in Brisbane. The growth slows down than previous months.

Louis Christopher, Managing Director of SQM Research said:

“Our rental market update today reveals a further decline in rental vacancy rates cross the nation. Most likely the fall in rental vacancies was driven by increased demand from tertiary students following the start of campus semesters for 2024. As well as graduates entering the workforce for the first time. It is a seasonal demand increase we see at the start of each and every year but is most certainly problematic due to the fact the current rental market remains in crisis.

Going forward, we believe vacancy rates are likely to decline again for the month of March as thus far weekly rental listings have fallen since the start of the current month.”

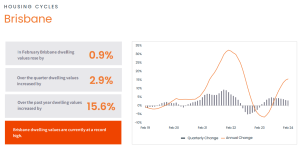

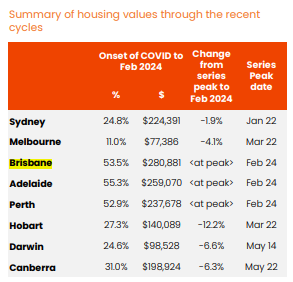

Property Values

- CoreLogic’s national Home Value Index (HVI) reported a widespread increase of 0.6% in February.

- Brisbane’s housing values continued to rise, with a monthly increase of 0.9%.

- The median dwelling value in Brisbane increased to $805,593.

- Compared to the onset of COVID, housing values in Brisbane have risen significantly by 53.5%.

CoreLogic’s research director, Tim Lawless, said: ““Potentially we are seeing some early signs of a boost to housing confidence as inflation eases and expectations for a rate cut, or cuts, later this year firm up.”

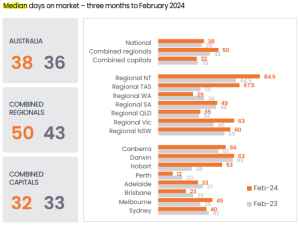

Median Days on Market

The time it takes to sell a home continued to trend higher in February. The median selling time for Brisbane increased slightly to 23 days from 22 days over the three months to January.

Cash rate

The RBA decided to leave the cash rate target unchanged at 4.35 per cent in March. The slower rate of growth in cost of living has supported the boost in confidence and brought forward forecasts of a rate cut.

Forecast

According to CoreLogic, signs of an optimistic change in market conditions extend beyond just an increase in value growth. They include a boost in consumer sentiment, inflation lower than projected, and a growing agreement that interest rates will decrease later in the year.

Suburb highlights – Eight Mile Plains

Eight Mile Plains had 51 properties available for rent and 44 properties for sale, less than previous month.

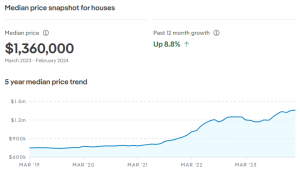

Median property prices range from $1,360,000 for houses to $585,000 for units.

Median price for houses-all Bedrooms:

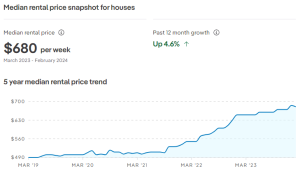

Median rent for houses reached $680 per week with annual rental yield of 3.2%.

Median rent for units remains at $580 PW with a rental yield of 5.0%.

Sources:

SQM Research. (2024). Vacancy Rates Continued to Decrease Over February Available from:

https://sqmresearch.com.au/uploads/12_3_24_National_Vacancy_Rate_February_2024_Final.pdf

CoreLogic. (2024). Hedonic Home Value Index. Available from:Housing values record a subtle re-acceleration in February as sentiment improves (corelogic.com.au)

CoreLogic. (2024). Monthly Housing Chart Pack. Available from: content.corelogic.com.au/l/994732/2024-03-10/215qhy/994732/1710053123dWnORybV/202403_monthly_chart_pack.pdf

realestate.com.au.(2024) Explore Suburb Profiles – Eight Mile Plains. Available from: https://www.realestate.com.au/qld/eight-mile-plains-4113/