Here is an overview of the Brisbane property market updates as per research from CoreLogic, PropTrack and SQM Research.

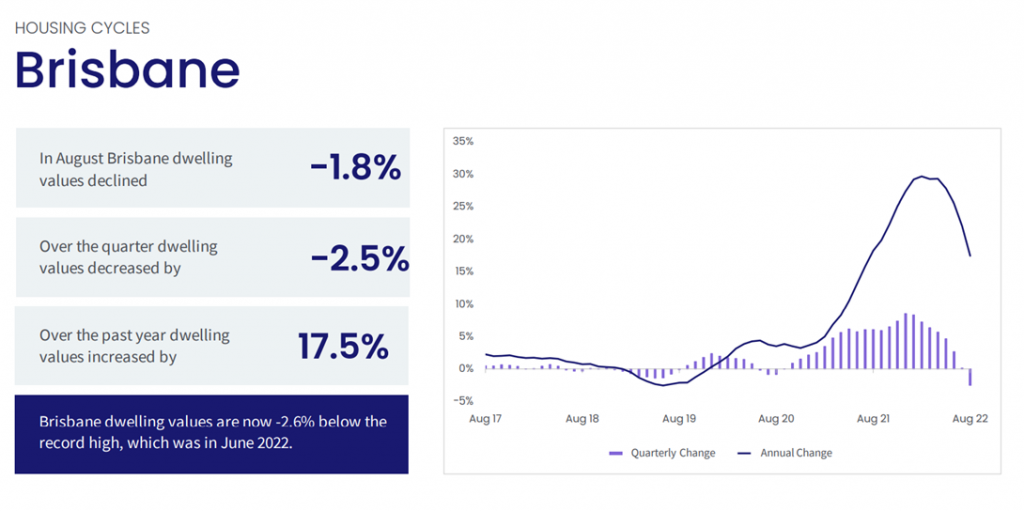

CoreLogic Research team reported that the rolling 28-day change in the combined capitals home value index fell a further -1.6% through the 28 days ending August 31st.

The rolling four week change in capital city values has been in negative territory since mid-May, with the rate of decline accelerating with successive cash rate rises.

The RBA lifted rates to 2.35% in September. The board emphasised it could increase interest rates over the months ahead, but is not on a ‘pre-set path’.

Listings in Brisbane

PropTrack published the latest Listings Report on 15 September:

Conditions for buyers in Brisbane continued to improve, with the fourth consecutive monthly increase in the total number of properties available for sale.

Brisbane’s property market had a busier August as activity started to pick up ahead of the typically busy spring season. New listings in August were up 7.1% compared to July and were up 17.4% compared to August 2021.

The good news for buyers is that these new listings, plus the fact that properties are taking longer to sell, mean the total stock of properties listed for sale increased 7.3% month-on-month in August. That marked the fourth consecutive month of increases in total listings, which is starting to improve choice and conditions for buyers.

Nonetheless, after a long period of strong demand, competition remains tough for buyers searching in Brisbane, with the total stock of properties listed for sale still down a bit less than a quarter compared to pre-pandemic levels.

Rental Market Update

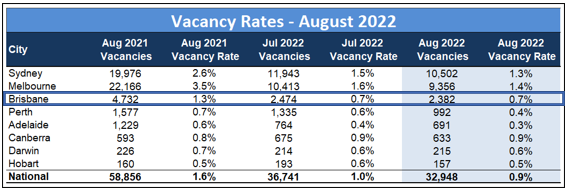

SQM Research released the latest rental market data on 13 September. It shows the national residential property rental vacancy rates fell to 0.9% through Aug 2022. This represents the lowest national rental vacancy rate since 2006 and is at unprecedented levels both in duration and scope when considering the sustained lack of rental properties over the past six months as well as the geographical extent of the crisis whereby all cities and regions are experiencing rental accommodation shortfalls.

Brisbane’s rental vacancy rates have remained steady from the previous month sitting at 0.7%.

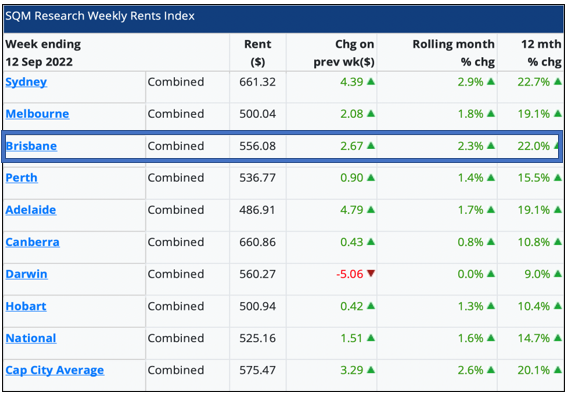

Over the past 30 days ending 12 Sep 2022, Brisbane’s asking rent rose by a further 2.3% and now stands at a 22% increase as of the last 12 months.

Louis Christopher, Managing Director of SQM Research said: “The national housing rental crisis has further deteriorated to unprecedented levels. And rental listings thus far recorded in September would suggest another fall in rental vacancy rates for the current month. I note the recent alerts and warnings issued by the various housing bodies as to what is happening on the ground and our data would concur with such concerning reports. Asking rents continue to rise across the country at a red-hot pace with combined national asking rents rising by another 1.6% for the past 30 days to 12 September. All capital cities are recording double digit percentage rental increases over the past 12 months.”

Referrences:

CoreLogic. (2022, Sep 7). Monthly Housing Chart Pack – September 2022. Retrieved from CoreLogic: https://www.corelogic.com.au/news-research/news/2022/monthly-housing-chart-pack-september-2022

Moore, A. (2022, Sep 21). PropTrack Listings Report – August 2022. Retrieved from realestate.com.au: https://www.realestate.com.au/insights/proptrack-listings-report-august-2022/

SQM Research. (2022, Sep 13). August Rental Vacancy Rates Drop Below 1%. Retrieved from SQM Research: https://sqmresearch.com.au/13_09_22_National_Vacancy_Rate_2022_FINAL.pdf