January is usually our busiest month for rentals.

Rental vacancy rates remained at 1.3% in Dec 2021 and fell to 1.1% in Jan 2022. Shortage of rentals have pushed the rental prices up and experts predict further rent increase.

SQM Research managing director Louis Christopher said, “All this represents an acute shortage of rental properties. And the shortage has already been translating into large surges in weekly rents across the country. It is now very likely market rents will rise by over ten per cent this year. Indeed, it could actually be much more than this as we are recording a rise in capital city combined rents of 5.2 per cent just in the last 90 days.”

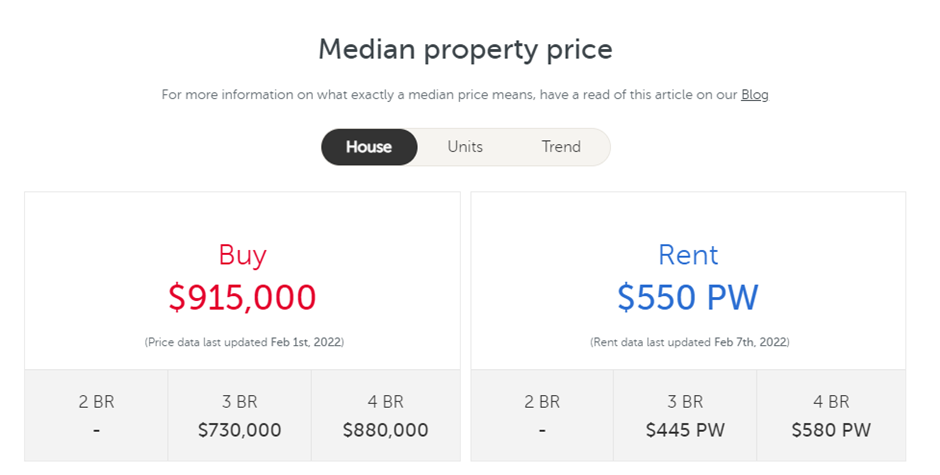

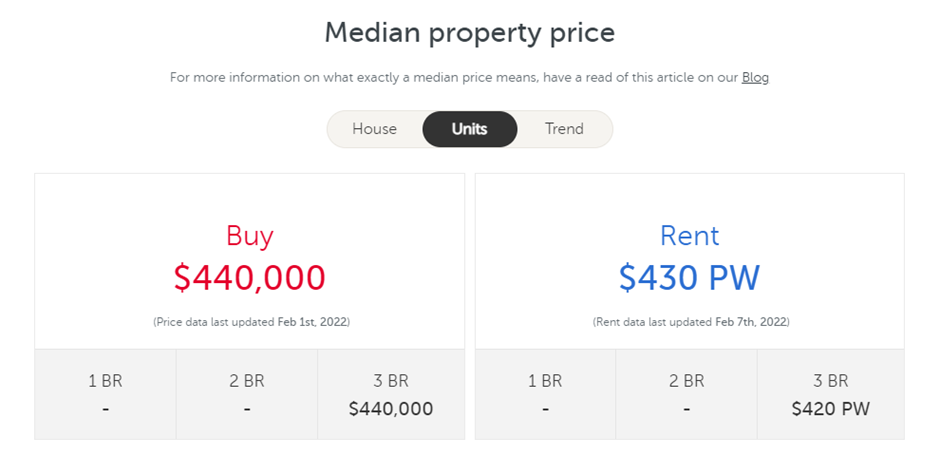

According to CoreLogic, national measure of housing values rose by 1.1% in January. The annual change in national housing values reached a new high in January. Brisbane’s housing values went up 29.2% (approx. $159,763), the highest annual growth rate across the capital cities.

CoreLogic’s Research Director, Tim Lawless commented that housing stock is thinly traded during January, and it will be important to monitor the trend as transactional activity picks up.

“As the volume of home sales moves out of seasonal lows, we should get a firmer reading on how 2022 is shaping up,” he said.

“The early indication is that housing markets are starting 2022 with a similar trend to what we saw through late last year. Values are still broadly rising, but nowhere near as fast as they were in early 2021.”

“A softening in growth conditions has been influenced by less government stimulus, worsening affordability, rising fixed term mortgage rates and, more recently, a slight tightening in credit conditions, and a surge in new listings through the final quarter of last year.”

Newly advertised stock in Brisbane was 46.8% lower than last year.

Mr Lawless said: “The trends in advertised supply levels go a long way towards explaining the performance of housing values. Melbourne and Sydney have seen inventory levels normalise over recent months, taking some urgency out of the market as supply and demand become more evenly balanced. The situation in Adelaide and Brisbane is very different; supply remains tight and buyer competition is a key factor supporting the upwards pressure on prices”

If you would like to know about the process and legislation about rent increase for existing tenancy, please feel free to read: FAQs: Rent Increases

Our suburbs – Eight Mile Plains Queensland 4113

We rented out 2 fully furnished properties in Eight Mile Plains and 1 in Runcorn recently with multiple applications. Properties are usually easy to rent in this area, popular with families, students and those on working holiday visas thanks to its convenient location – close to Sunnybank and Garden City Shopping City, easy transport to the City and close to well-known schools.

Client & Tenant Feedback

Thank you Rick, for your 5 Star Google Review: “Cindy has been by far the best property manager we have ever dealt with. She provided us an excellent service, communicated extremely well and was lovely to work with :)”

Sources:

https://www.realestate.com.au/news/rents-to-rise-as-brisbane-vacancy-rate-hits-16year-low/

FAQs: Rent Increases: https://www.reiq.com/articles/faqs-rent-increases/