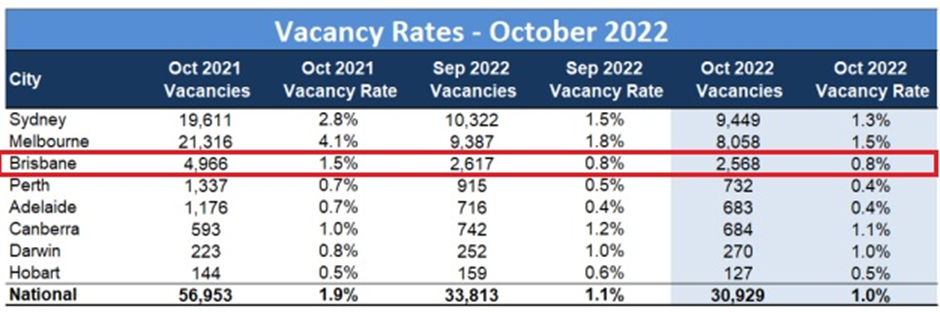

National Rental Vacancy Rates Fell in October

SQM Research has revealed national vacancy rates fell in October to 1% from a revised* 1.1% recorded in September.

Brisbane vacancy rates sat at 0.8%, and Brisbane CBD fell to 1.2%.

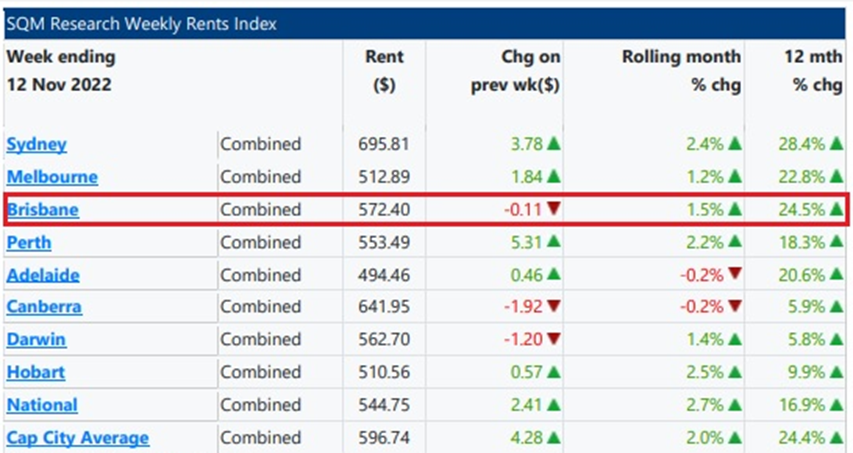

Over the past 30 days to 16 November 2022, Brisbane asking rents rose by another 1.5% with the 12-month rise standing at 24.5%.

Over the past 30 days to 16 November 2022, Brisbane asking rents rose by another 1.5% with the 12-month rise standing at 24.5%.

Louis Christopher, Managing Director of SQM Research said: “The national rental market is still very much in favour of landlords, particularly for our capital cities where there is no evidence yet of any easing in the rental market.

However there is some good news for tenants in a number of townships and regions outside the capital cities whereby SQM Research is now recording a consistent rise in rental vacancy rates, albeit from a very low base. This easing might be attributed to a population flow back into the cities whereby an increasing number of white-collar workers are being asked to come back into the office. However, if we are correct in this assessment, this means the capital city rental market will continue to be under great strain for tenants over the foreseeable future and may not ease until late 2023 at the earliest.

And as we can see through the asking rent increases over the past 30 days, the capital city rental crisis remains with us to this day.”

Dwelling Values

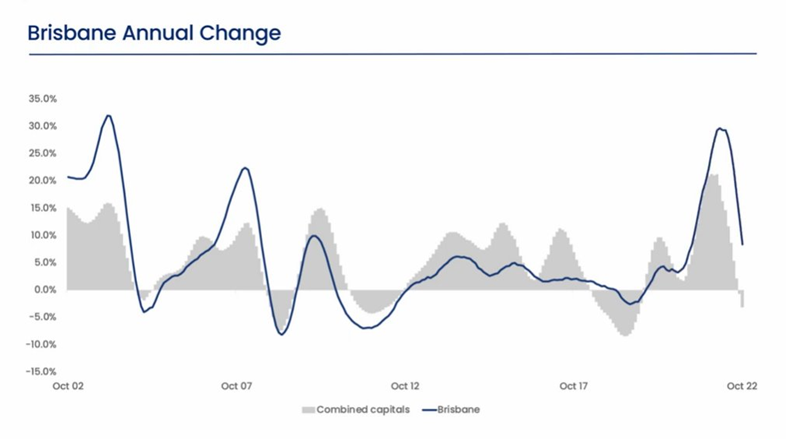

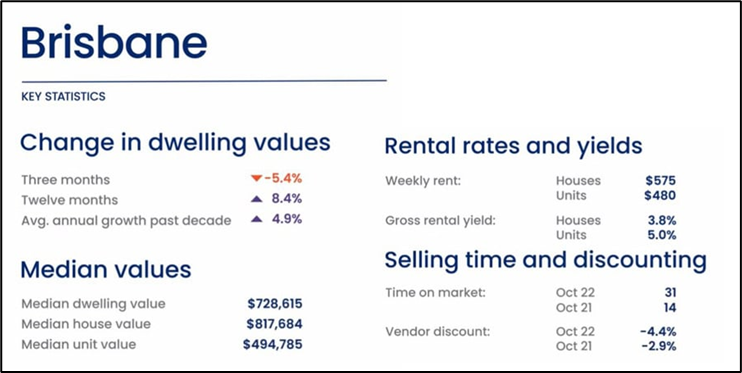

Corelogic’s latest data shows: with a 2.0% fall in dwelling values through October, Brisbane recorded the largest monthly declines of any capital city or broad rest of the state region. Since values peaked in June, the market is down 6.2%, or in dollar terms, down about $48,300.

The decline comes after a dramatic run-up, where values increased by almost 43% during the growth phase. Brisbane’s unit market is recording a substantially milder decline, with values down 1.2% since peaking, compared with a 7.2% drop in house values.

While values are falling, rents are surging. House rents are up 13.6% over the past year and unit rents are up 13.1%.

Prices continue to soften as rate hikes

Joanna Boyd, Buyers Advocate reported: The Brisbane property market has officially settled down into a semblance of “normality”, but buyers are questioning do I buy now or wait until the market drops more?

Brisbane is still offering good capital growth and solid rental yields and can be considered somewhat as a buyers’ market currently with great opportunities being presented during this uncertain financial landscape.

The median values are trending downwards because of these changing market conditions, but prices are remaining relatively stable as Brisbane demonstrates a less volatile marketplace compared to other capital cities.

Over the past months, we have observed what appears to be a “Mexican Standoff” between sellers and buyers. Sellers are still setting prices in their minds with figures that were being achieved six months ago, whereas buyers are not feeling as pressured to pay for a property above what they perceive to be the current market value. The urgency and FOMO has been reduced and buyers are making more informed decisions through additional research and due diligence, however, the FOMO will return in the coming months with the usual interstate migration occurring over the Xmas/New Year period for jobs and schooling opportunities.

Just Listed – For Sale

We’re excited to announce a new listing as one of our owners has recently decided to sell their investment property. I greatly appreciate their trust and support. This unique and quality home is not to be missed. Please contact me for more details if interested.

References

SQM Research. (2022). National Rental Vacancy Rates Fell in October. Retrieved from SQM Research: https://sqmresearch.com.au/16_11_22_National_Vacancy_Rate_2022_FINAL.pdf

CoreLogic. (2022). Monthly Housing Chart Pack – November 2022. Retrieved from CoreLogic: https://www.corelogic.com.au/news-research/news/2022/monthly-housing-chart-pack-november-2022

Boyd, J. (2022). Investors Offload Dwellings En-masse But Remain Upbeat About Year Ahead. PIPA Adviser(28), 16. Retrieved from https://www.pipa.asn.au/wp-content/uploads/PIPA-Adviser-28-WEB.pdf