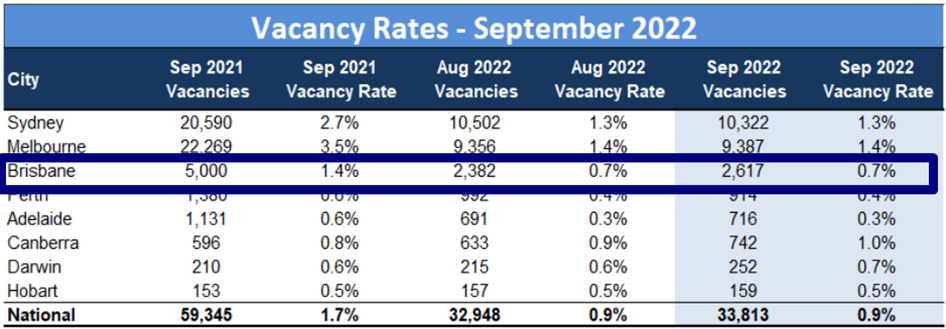

SQM Research has revealed national residential property rental vacancy rates have remained constant at 0.9% in September 2022. This represents the lowest national rental vacancy rate since 2006.

Vacancy rates in Brisbane remained at 0.7% while Brisbane CBD rose to 2%.

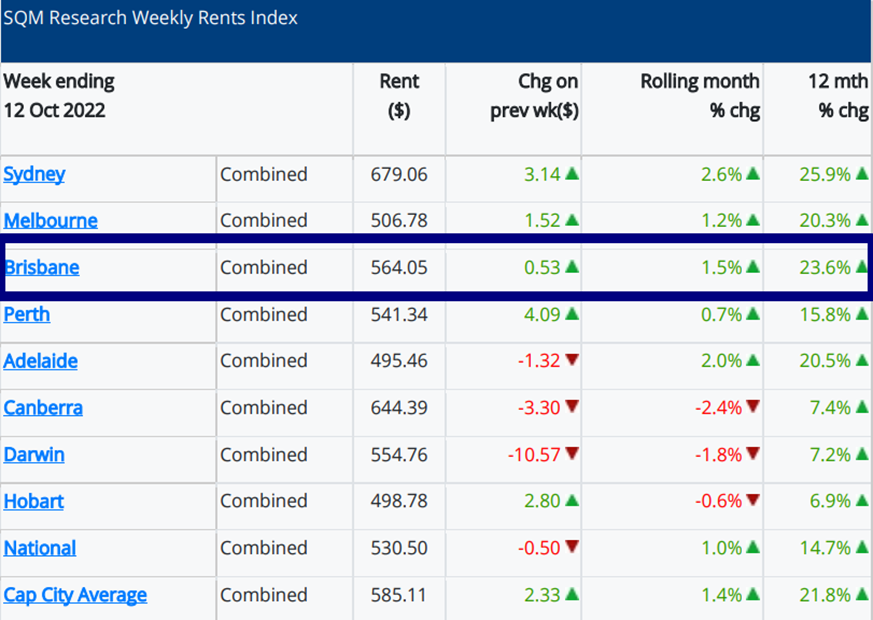

Over the past 30 days to 12 October 2022, Brisbane asking rents rose by another 1.5% with the 12-month rise at 23.6% (house & unit combined), higher than the capital city average of 21.8%.

Louis Christopher, Managing Director of SQM Research said: While the rental vacancy rate remained steady at 0.9%, there was actually a slight increase in vacancies over the month driven by a rise in new rental listings compared to August. We note there was also a rise in rental vacancies within the Sydney, Melbourne, and Brisbane CBDs.

Overall, the rental market remains extraordinarily tight and so it is little surprise to note yet another month of asking rent increases. Over the past 30 days we have combined national asking rents up by a further 1%.

Going forward, history tells us when we reach the late spring, early summer period, we could see a seasonal increase in vacancies. However there remains a structural issue with the rental market for which increases in construction of new dwellings will only resolve.”

House values

CoreLogic’s latest research showed growth conditions across Brisbane fell into negative territory over the quarter, with house values falling -5.1%. Just 5.7% of suburbs analysed saw values rise in Q3, 15 of which were located in Ipswich, and four in Logan – Beaudesert. However only two suburbs recorded a decline in house values compared to this time last year, Chermside (-1.8%) in the north, and Fairfield (-0.3%) in the south. Despite recording significant growth over the past two years, 70.5% of Brisbane’s house markets have a current median value below $1m, and 11.0% have a median value under $500,000.

After rising 3.5% over the June quarter, unit values across Brisbane rose just 0.4% over the three months to September. Despite the overall rise, unit value declines have become more common at the granular level, with 46.7% of the 169 suburbs analysed recording a quarterly decline in values, up from 5.6% in June. These suburbs were largely concentrated in the Inner City (25), as well as Brisbane’s South (17), East (12) and Logan – Beaudesert (12). None of the suburbs analysed saw unit values fall over the 12 months to September.

Sources:

CoreLogic Australia. (2022). Almost 80% of Australia’s house and unit markets now in decline. CoreLogic Australia. Retrieved 19 October 2022, from https://www.corelogic.com.au/news-research/news/2022/almost-80-of-australias-house-and-unit-markets-now-in-decline.

SQM Research. (2022). September Vacancy Rates Remain Constant at 0.9% [Ebook] (pp. 1-3). Retrieved 19 October 2022, from https://sqmresearch.com.au/12_10_22_National_Vacancy_Rate_2022_FINAL.pdf.