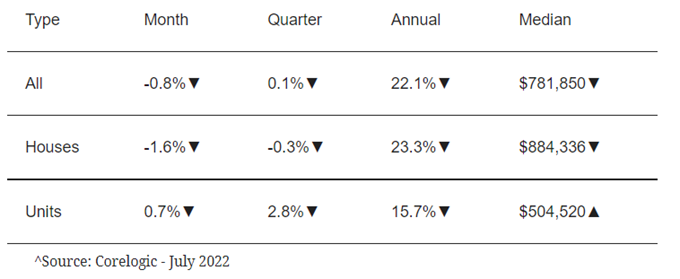

Corelogic’s research report dated 1 Aug shows that Australian dwelling values fell by 1.3% in July, marking the third consecutive month CoreLogic’s national Home Value Index has fallen. After national dwelling values surged 28.6% through the pandemic growth phase, values are now -2.0% below April’s peak.

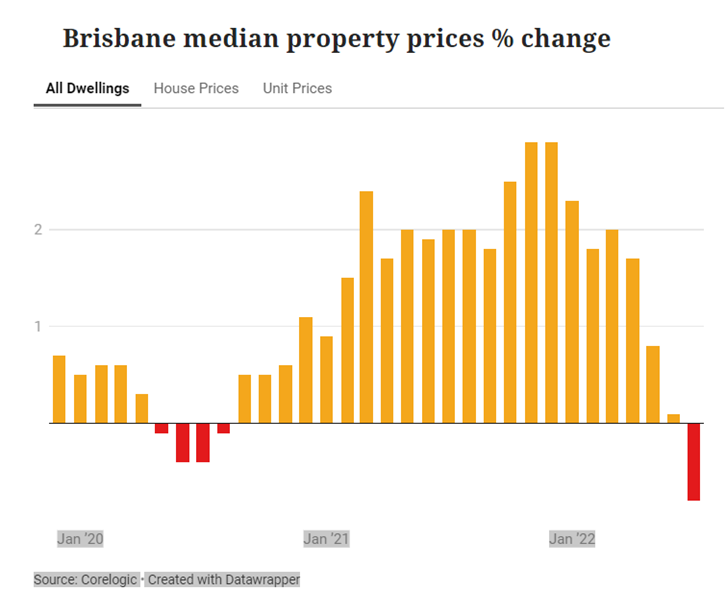

House values in Brisbane edged into negative growth territory for the first time since August 2020, with values down -0.8%.

CoreLogic’s Research Director, Tim Lawless, said housing market conditions are likely to worsen as interest rates surge higher through the remainder of the year.

“The rate of growth in housing values was slowing well before interest rates started to rise, however, it’s abundantly clear markets have weakened quite sharply since the first rate rise on May 5,” he said.

PropTrack forecast falling house prices and increase of property investment. The report shows: with property prices falling and rental rates increasing, we expect the share of lending to investors will continue to climb over the coming months. This is especially the case given an increasingly compelling set of circumstances for residential property investment and the fact that the cost of units (which tend to be more likely to be rented) have seen very little, if any price growth in the major capital cities over recent years.

Rental market overview

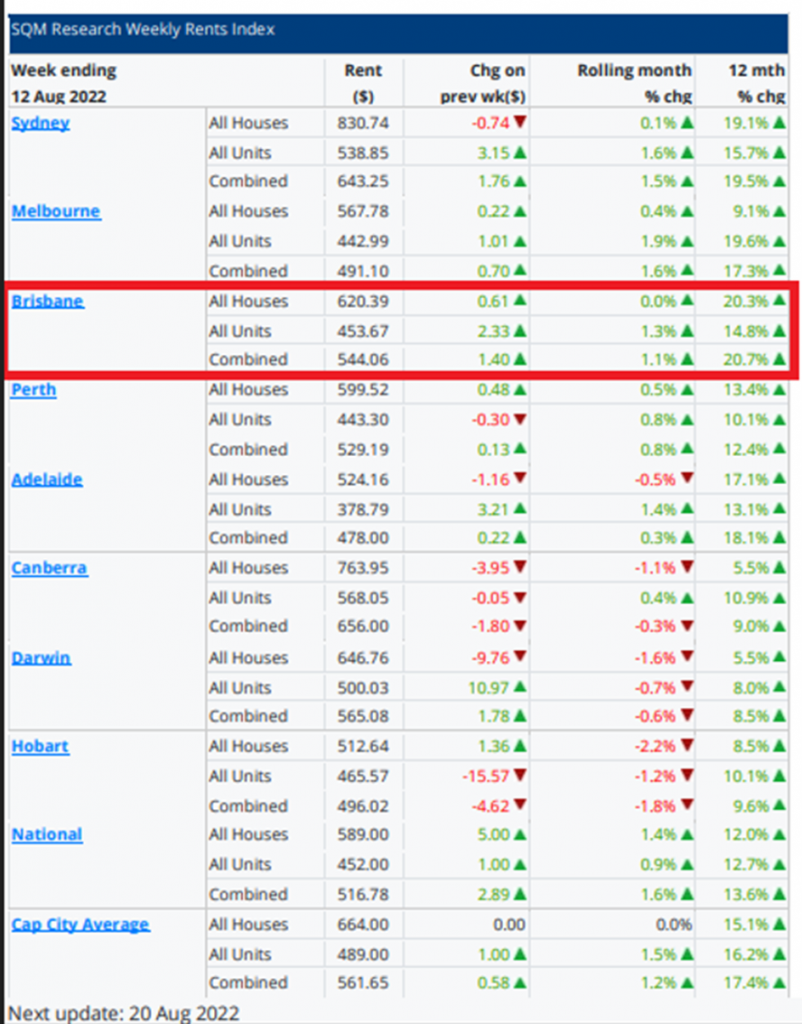

SQM Research dated 15 August revealed national residential property rental vacancy rates remained steady at 1% in July 2022.

Brisbane recorded an increase in rental vacancy rates to 0.7%. Vacancy rates in the Brisbane CBD fell to below average level at 2.2%.

Over the past 30 days to 12 August 2022, Brisbane asking rents rose by another 1.1% with the 12-month rise standing at 20.7% (house & unit combined).

Louis Christopher, Managing Director of SQM Research said: “We appear to be recording more evidence of a small easing in rental conditions. If it wasn’t for the falls in rental vacancies in Sydney and Melbourne, the national rental vacancy rate would have recorded a rise for the month of July as there were vacancy increases in most other capital cities and in many regional locations. That said, the rental market by and large remains very tight. And now, with the falls in CBD rental vacancies rates to well below average, we have evidence that the rise in overseas arrivals is starting to put some additional demand pressure in certain pockets of the rental market. We will wait to see if the increased immigration demand creates pressure elsewhere. Meanwhile, rents continue to sharply rise in most locations, albeit SQM is now recording falls in rents for Canberra, Hobart and Darwin, which will at least provide some relief to local tenants.”

Sources:

https://www.realestate.com.au/insights/proptrack-property-market-outlook-july-2022/

https://sqmresearch.com.au/11_08_22_National_Vacancy_Rate_2022_FINAL.pdf