Our hearts go out to people who lost their homes or were affected by the storms and flood in February.

Please join REIQ’s campaign to Help House a Queenslander – if you have a vacant property, holiday home, short term rentals, please consider changing it to a long term rental. We’re more than happy to assist you.

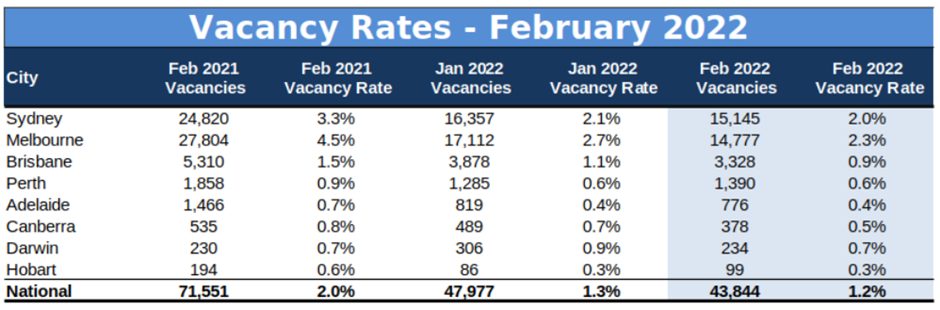

Vacancy rates in Queensland had reached historic lows even before the flood.

Brisbane’s rental vacancy rates dropped further from 1.1% in Jan 2022 to 0.9% in Feb 2022.

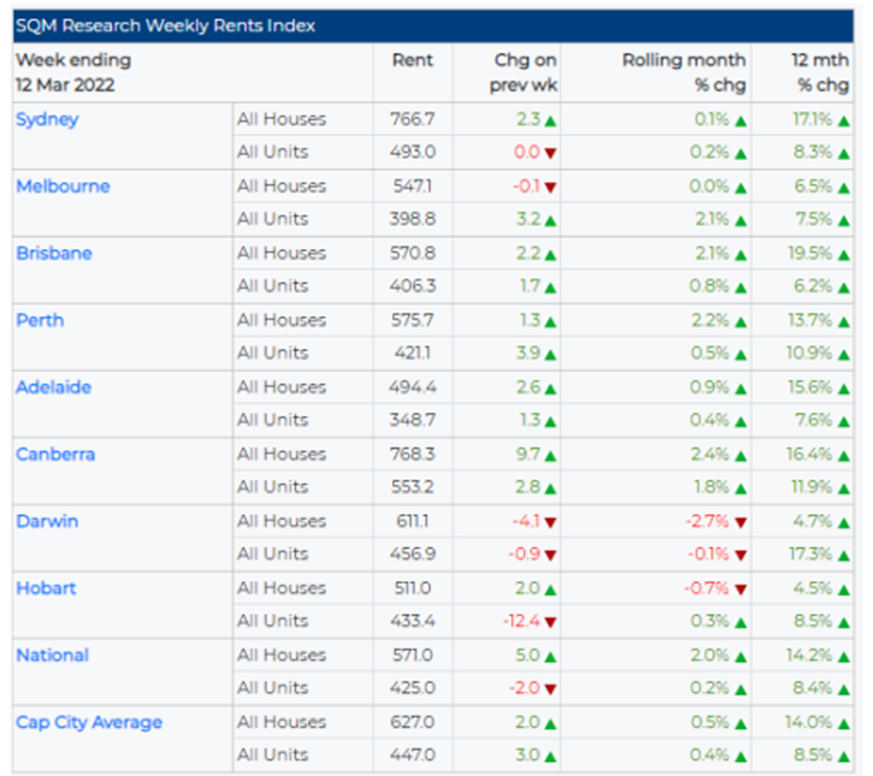

Louis Christopher, Managing Director of SQM Research said: “Given a dramatic tightening in vacancy rates, we are seeing an ongoing acceleration in weekly market rents across the capital cities. This situation now represents a significant rental crisis across the country. The flooding may exacerbate the shortage of rental accommodation in NSW and Queensland in coming weeks. And the new surge in international students and other overseas arrivals will continue to create shortages in our inner-city regions.”

“All the same, we can expect capital city rents to rise by over 10% in 2022. As it stands, the current rent rises represent the largest increase since the 1970s and so there are major near terms ramifications for inflation. Housing is the highest weighted group in the CPI, accounting for around 23% of the basket,” said Christopher.

Asking rents: Brisbane’s rental prices rose by 2.1% over the month and by 19.5% for houses and 6.2% for units over the last 12 months.

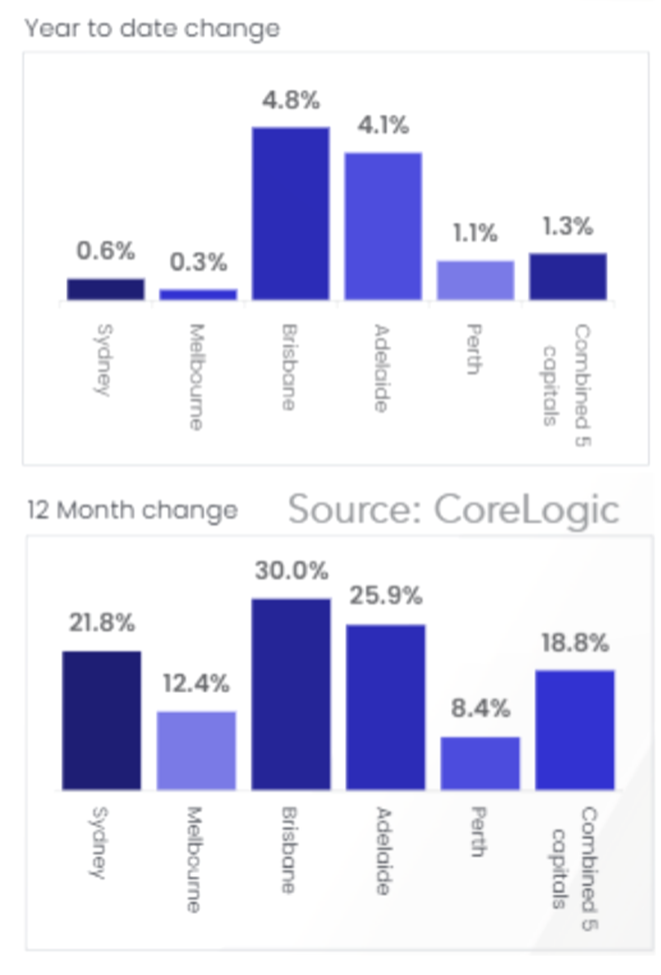

Property prices: Brisbane continued to outperform other capital cities with a 12 month increase of 30%, rose by around 5% from Nov 2021.

PIPA adviser said: “things are good, but signs are emerging that we are passing through a peak growth period.”

Capital city home value changes – CoreLogic data to 6 March 2022

Advice from PIPA adviser: Buying will be about choosing the right fundamentals. Smart investors will dodge the dud spots, look for assets with broad market appeal to both owners and tenants, and rely on information from trusted and experienced professionals.

Office Market

We were excited to lease an office in Salisbury that we started advertising in Nov 2021.

According to the Property Council of Australia, total vacancy rate across the country was 12.1% in Jan 2022, significantly increased from 8.4% in Jan 2020. As many employees prefer continue to work from home, rents remain flat and incentives are high at the moment. However, experts advised that there are signs of some confidence returning to the market.

Sources:

https://sqmresearch.com.au/15_03_22_National-Vacancy-Rate-Falls-In-February-2022_SQM-Research_FINAL.pdf National Rental Crisis Emerges as Vacancy Rate Drops to Fresh 16 Year Low

PIPA – Property Investment Professionals of Australia – 26th edition of the PIPA Adviser