Brisbane’s property market remains strong while property prices in Sydney and Melbourne have been falling.

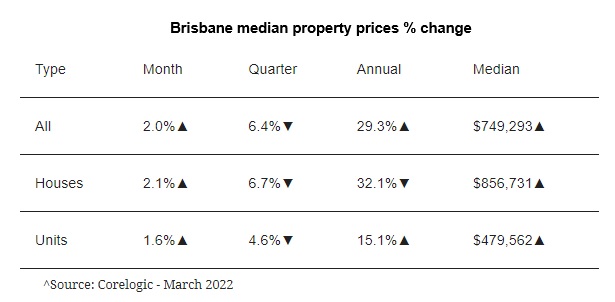

Dwelling prices kept rising for the quarter to March 2022. Though growth was slower than 2021, there were no signs property values would drop as increased interstate migration, low stock and heightened demand were expected to continue.

Brisbane’s house prices have rose by 32.1% in the past 12 months, with the median price reached $856,731.

Despite the recent floods, not one Brisbane suburb has seen a drop in quarterly or annual prices for houses.

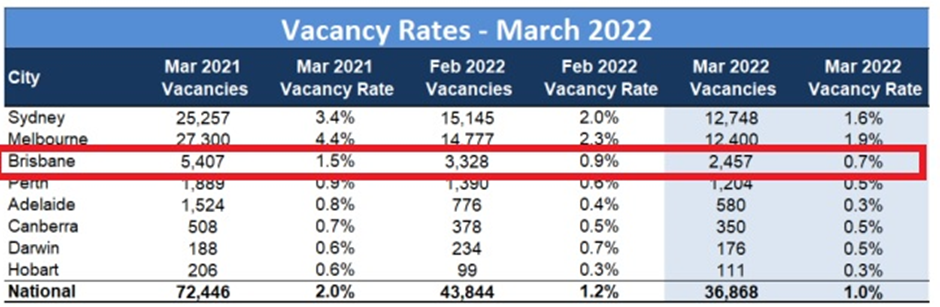

SQM Research recorded that Brisbane’s vacancy rates fell from 0.9% to 0.7% in March 2022.

Asking Rents

Brisbane recorded the highest 12 month rental increase of 15.2% for houses and units combined.

Louis Christopher, Managing Director of SQM Research said: “The rental crisis has deepened with rental vacancy rates across the country falling to just 1%. As a result, market rents have exploded…And the recent monthly data suggests we are still not at the worst point of the crisis. “

According to The Urban Developer: Low stock, delayed development and interstate migration continue to throw fuel on the city’s rental fire, and industry experts say the latest price rises will not be the last.

Houses across Brisbane East had the biggest annual rent rise of 18.8%, seeing the median weekly rents reached to an unprecedented $570.

In Moreton Bay South, house rents rose by 15.1% to $495 a week, meanwhile, in Logan, Beaudesert house rents jumped 15.8% to $440.

What the experts are saying

Eliza Owen, Head of Research Corelogic said: “While growth rates have eased from a peak late last year, Brisbane is expected to remain a relatively resilient market amid potentially higher interest rates.”

Antonia Mercorella, Chief Executive, REIQ:“We’re experiencing the perfect storm of low housing supply levels, incredibly high interstate and intrastate migration particularly to our regions, longer length tenancies as tenants choose to stay put for greater security and certainty, and less shared tenancies as people want more space now they’re working from home.

“Demand for rental properties in Queensland will continue to rise along with the rising population and that growing population needs a roof over its head.

“Queensland needs additional housing supply to ease these tight conditions and accommodate the masses relocating to the state, and this supply simply can’t come soon enough.”

Louis Christopher, Managing director, SQM Research: “Clearly, we are not going to resolve this overnight, but I do hope the various state and territory governments will ramp up their rental assistance packages in order to cushion the rental accommodation emergency we have here and now.”

Source:

https://www.theurbandeveloper.com/articles/brisbane-housing-market-update

https://sqmresearch.com.au/12_04_22_National%20Vacancy%20Rate%20Falls%20In%20March%202022_FINAL.pdf