End of financial year – investors’ checklist

- Tax planning

- Tax depreciation schedule

- Be aware: we were informed by our trust account software provider that they’re are obliged to provide data in the system to ATO, which means ATO has access to landlords’ rental income if they’re using a real estate agency like us to manage their investment properties.

Market update

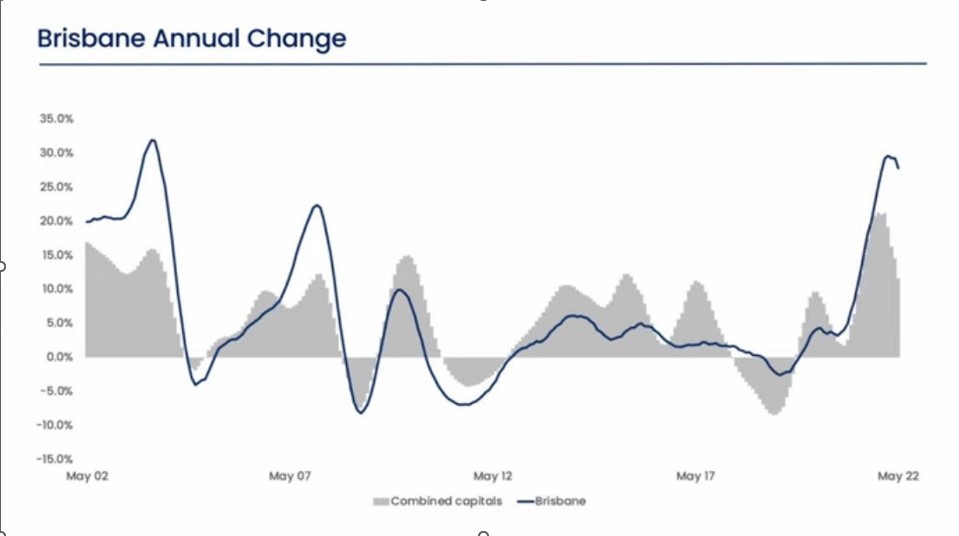

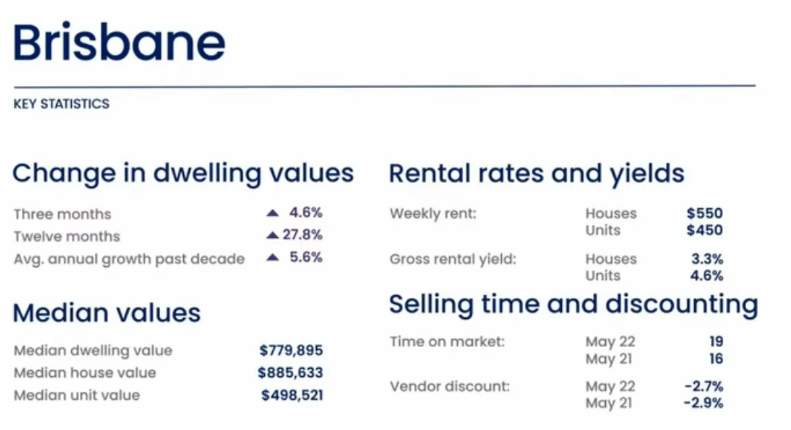

Data from Corelogic revealed that Brisbane housing values have continued to trend higher, although the trend rate of growth has nearly halved from the recent peak in December 2021 of 8.5% over the quarter. It has since eased back to 4.6% over the rolling quarter, which is still outperforming the national average growth rate of 1.1%.

A key factor supporting Brisbane’s ongoing price growth is that listings remain extremely low.

At the end of May, total advertised stock levels were holding 28% below the five-year average in Brisbane.

At the same time, home sales have eased but remained approximately 15% above the five-year average in May.

With demand continuing to outweigh available supply, homes are selling in just 20 days on average with minimal levels of discounting.

Video: Brisbane Housing Market Update | June 2022

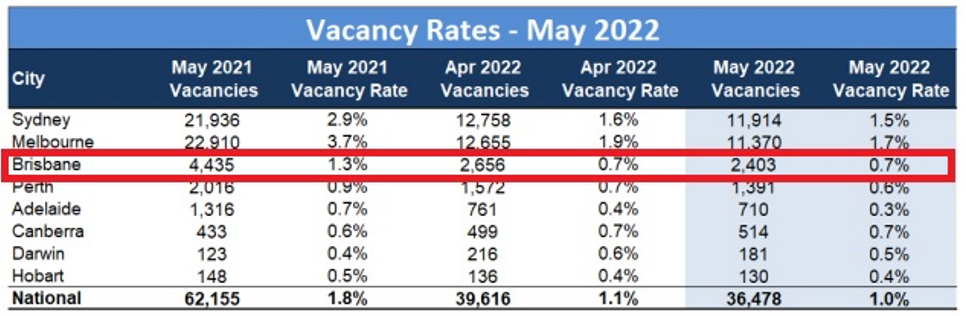

Vacancy rates

Latest SQM Research dated 15 June 2022 shows that national residential property rental vacancy rates fell to 1% in May 2022, from 1.1% in the month of April. In Brisbane, vacancy rates sat at record low of 0.7%.

Asking Rents

Over the past month to 15 June 2022, Brisbane asking rents (house and units combined) rose by another 1.8% with the 12-month rise standing at 18.6%. House rents are recording 12 month increases of 22%, while unit rents have risen by 11.2%.

Louis Christopher, Managing Director of SQM Research said: “Rental vacancy rates continued to tighten across the country and there is nothing yet in the data that would suggest we are about to see a reprieve. The national rental crisis continues on unabated and as a result, asking rents are skyrocketing. Sydney combined rents have risen by 17.5% just over the past 12 months. Brisbane is up by 18.6% for the same period. Melbourne up by 14.8%. Reductions in household size, short term stay listings eating into longer term lease availability and now the likely rise in immigration levels, are all factors contributing to this crisis. There will also be ramifications for headline inflation once the Australian Bureau of Statistics update their rental series with the actual market.”

Source:https://propertyupdate.com.au/brisbane-housing-market-update-video/

https://sqmresearch.com.au/15_06_22_National_Vacancy_Rate_2022_FINAL.pdf