Brisbane’s typically slow-moving property market has continued to rise as part of a once-in-a-decade boom that experts say could fuel a further 10 per cent rise in house prices in the coming year.

Vacancy rates

Over April, the national residential rental vacancy rate dropped to 1.9%. Suburban vacancy rates continued to fall across Australia. Consequently, landlords have begun demanding huge rent increases in certain locations including the Gold Coast and North Coast NSW. Brisbane’s vacancy rates continued dropping to 1.4%.

Rental values

Over April, asking rents across Australia’s capital cities rose by 0.4% for houses and 0.2% for units. Compared to the previous year, Brisbane asking rent rose by 6.8% for houses , and 2.8% for units.

Property prices

Brisbane house prices have soared to record heights for the seventh consecutive quarter, with tight stock levels and strong demand across all demographics increasing competition.

Investors have also made their way back into the market and competition is heating up.

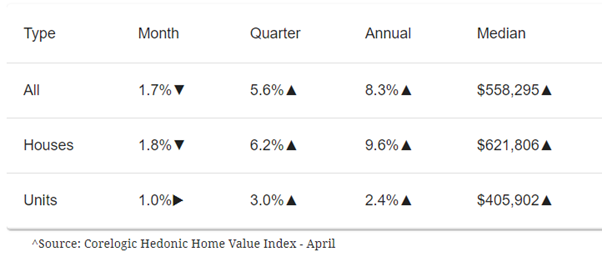

The latest Corelogic home value index shows Brisbane dwelling prices have risen by 1.7 per cent on a rolling four-week basis.

Brisbane house prices advanced a further 1.8 per cent during April, pushing it up 6.2 per cent for the recent quarter and 9.6 per cent for the year to date.

The current median value for dwellings is $558,295 which is $10,000 higher than just a month ago.

The median house price of $621,806 continues to attract interstate migrants from the larger markets of Sydney, where the median is now $1.14 million, and Melbourne at $869,676.

The current median unit price in Brisbane is $405,902, which is $5,000 more than one month ago.

Brisbane’s housing market: policy updates

Brisbane’s housing market has remained particularly unaltered by the closure of international borders, where historically high demand from overseas migrants has been disrupted.

Tight stock levels and strong demand across all demographics have made it incredibly difficult not only to find a property to buy but to also secure something at a reasonable price.

Loan data shows investors have started coming back into a housing market they had largely vacated and the boom is being driven overwhelmingly by established owner occupiers.

Another big part of the demographic buyer base helping drive demand in Brisbane has been first homebuyers.

Brisbane’s proportion of home loans that remained on deferral at the end of March was just 0.7 per cent, indicating a very very low likelihood of distressed selling.

The seasonally adjusted estimate for total dwelling units approved in Queensland in March was 4547, 12.1 per cent up on February’s figures.

Australia’s central bank will maintain low interest rates to support the country’s ongoing economic recovery and surging housing market, buoyed by its busiest Easter auction market on record.

Read more: RBA Policy Underscores Strong Recovery

Strong tailwinds will bolster the Australian economy through the second half of the year, but macro-prudential measures are likely to be introduced to ease house price pressures in 2022.

Read more: Prudential Changes to Curb House Prices

Sources:

May property market update:https://www.propertyme.com.au/blog/industry-news/may-property-market-update-2021 Brisbane Housing Market Insights: May 2021: https://www.theurbandeveloper.com/articles/brisbane-housing-market-update