The Queensland rental market has tightened over the March quarter, highlighting the increased demand for rental accommodation across the state in light of the recent Federal Elections. The Inner Brisbane rental market saw a large shift in vacancies over the March quarter – moving back into the tight range with the market showing its resilience and ability to absorb the supply of new rental stock to the market.

Revised quarterly vacancies for the Gold Coast highlighted the market is tight for a third consecutive quarter with annual median rents continuing to trend upwards, indicating the high demand for coastal properties.

Vacancies across the Sunshine Coast softened over the March quarter and have begun to shift from a tight to a healthy status. Subsequently, annual median rents in the region have remained unchanged for the March quarter indicating a fall in demand for some rental properties with the exception of Noosa which posted 4% rental growth and saw vacancies remain tight. The driver for strong rental performance in the area is an increase in owner-occupiers, limiting the rental stock and in turn putting pressure on rents.

The Rockhampton rental market remained unchanged for the March quarter with vacancies remaining tight at 2 per cent. Rental demand in the region continues to increase with annual median rent growth sitting at 5 per cent over the year to March 2019 – the demand supporting the regions ability to absorb new rental stock.

The majority of rental markets analysed in the Queensland Market Monitor experienced median rent growth over the year to March 2019 but Mackay and Gladstone outperformed, in particular, the unit market posting approximately 17 per cent and 13 per cent rental growth respectively. Both of these regions historically experienced weak vacancies but these rates are beginning to tighten and fall into a healthier status. Over the year to March 2019, vacancies in Gladstone have tightened 1 percentage point to 3.1 per cent, which has put upward pressure on rents and subsequently categorised it as a healthy rental market.

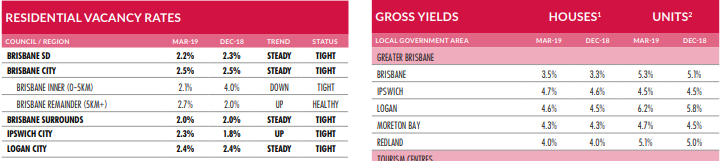

Vacancy rates Mar-19 vs Dec-18

Source: Queensland Market Monitor JUNE 2019