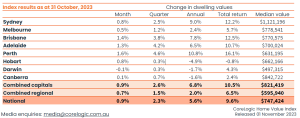

The CoreLogic Home Value Index indicates that dwelling values in Brisbane reached a new record high, rising by 1.4% in October, contributing to a remarkable overall rise of 10.2% in the first 10 months of the year. Low levels of supply have been a key factor supporting the recovery despite rate hikes.

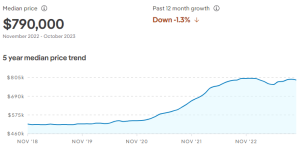

According to realestate.com.au, the overall median price for houses (all bedrooms) in Rochedale South decreased by 1.3%, it’s noteworthy that the median price for four-bedroom houses reached a record high at $850,500, marking a 1.2% increase in October.

Furthermore, with the fast rise in dwelling values in Brisbane, we anticipate more buyers from Brisbane will be attracted to Rochedale South, given its close proximity and affordability.

Rochedale South

– 48 properties for rent

– 51 properties for sale

– Median Price for houses $790,000

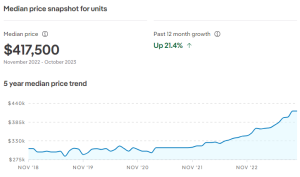

– Median Price for units $417,500

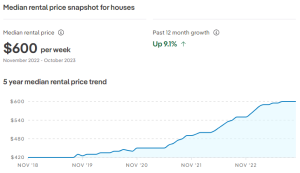

– Rental price for houses: $600 PW with annual rental yield of 4.3%

– Units rent for $450 PW with a rental yield of 5.8%.

Rental vacancy rate

SQM Research reported that the national vacancy rate has continued to fall to 1.0% in October. Brisbane saw the vacancy rate dropped from 1% to 0.9%. Vacancy rates are sitting at record low and the rental market is very tight across the country, although there is no specific report on Logan in October.

According to realestate.com.au, the median rental price for houses (across all bedrooms) saw a significant 9.1% increase in the past 12 months, reaching $600 per week.

The median unit price (across all bedrooms) experienced a noteworthy surge of 21.4% over the past 12 months, with the median rent for units also showing substantial growth at 21.6% during the same period.

Louis Christopher, Managing Director of SQM Research said: “After a minor reprieve earlier this year, we are back to the record low in rental vacancies of 1.0%. Vacancies have been tightening again across the nation. They are tightening in our regions as well as our cities.

In such an environment, the prospect of an easing in rents over the next six months is very unlikely to occur. And most likely, market rental increases will continue to rise between 10 to 15%. Such rises will continue to work against the RBA’s objective of bringing back inflation to 2% to 3%.

Given 2024 is very likely to see a fall in dwelling completion to about 153,000 dwellings, the only real prospect of having some relief in the rental market next year is a cap on migration rates. I have no doubt the runaway population growth Australia has had, since the start of 2022 is directly contributing to our rental crisis and towards other price rises in the greater economy.”

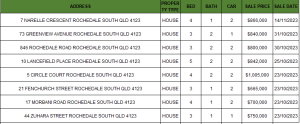

Recent Sales

Client Feedback

Sources:

SQM Research. (2023). Rental Market SqueezeOctober Vacancy Rates Back to 1.0%. Available from: https://sqmresearch.com.au/uploads/14_11_23_National_Vacancy_Rate_October_2023__Final..pdf

CoreLogic. (2023). Hedonic Home Value Index. Available from: https://www.corelogic.com.au/__data/assets/pdf_file/0018/19161/CoreLogic-HVI-Nov2023-FINAL.pdf

CoreLogic. (2023). Monthly Housing Chart Pack. Available from: https://www.corelogic.com.au/news-research/news/2023/monthly-housing-chart-pack-november-2023

realestate.com.au.(2023) Explore Suburb Profiles – Rochedale South. Available from: https://www.realestate.com.au/qld/rochedale-south-4123/